|

|

|

| 392-ct Sapphire Sells for $17.3 Million | |||||||

The world's fourth largest faceted sapphire, the "Blue Belle of Asia," sold for nearlly $17.3 million at Christlie's Geneva sale of Magnificent Jewels - a world record for any sapphire sold at auction, according to Christlie's. The 392.52-carat cushion shaped Ceylon sapphire exceeded its high estimate of $10 million. The gem was discovered in 1926 at Pelmadula, Ratnapura, in Ceylon and was sold to British motor magnate Lord Nuffeld (1877-1963), founder of Morris Motors Limited, according to the auction house. It was said that he purchaseed the sapphire to present it to Queen Elizabeth on her Coronation Day on May 12, 1937. The gem is suspended on a diamond tassel pendant and attached to a diamond neckchain mounted in gold. |

|||||||

|

|||||||

It was one of several big ticket items at the auction, which achieved moe than $150.2 million, with 89 percent sold by lot and 94 percent sold by value. Christlie's said it was "the highest total for any Magnificent Jewels sale in the world." World renowed diamond jeweller Laurence Graff acquired a pair of ear pendants, featuring a 6.95 carat, pear-shaped fancy vivid blue diamond, and a 6.79 carat, pear-shaped fancy vivid pink diamond, for more than $15.8 million. Previously known as the "A Bulgari Masterpiece," the fancy diamonds are topped with marquise and pear-shaped diamond clusters weighting approximately 19.28 carats. The high estimate for the item was $15 million. One of the more anticipated lots was the "Feullies de Grosellier" brooch, commissioned in 1855 by Empress Eugenie of France to French jeweller Alfred Bapst. It was part of the French Crown Jewels, it sold for more than $2.3 million, within its estimate of $2 to $3 million. |

|||||||

Christie's

said more than 600 persons from 30 countries registered for the

auction. Other notable sales included the JAR "Parrot Tulip" bangle bracelet that realized more than $3.5 million, nearly double its high estimate and the second highest price for a creation by JAR; and an Art Deco natural pearl and diamond necklace from private collection of the Baroness Edouard de Rothschild that sold nearly $5.2 million. |

|||||||

| Victoria's Secret Has 2 Fantasies | |||||||

| Every

year before its fashion show, Victoria's Secret unveils a gem-adorned

"Fantacy Bra," many times created in collaboration with

renowed jeweller Mouawad. For 2014, the company has announced that for the first time it is doubling up on the fantasy, having had two Dream Angles Fantasy Bras crafted. Both are valued at $2 million each and are adorned with more than 16,000 gems. Accompanying the bras are arm, leg, stomach and neck pieces of the fine gemstones, strung together on 18-karat gold chains Victoria's Secret said that the bra took more than 1,380 hours to create, as each is handset with rubies diamonds, and blue and light blue sapphires. |

|||||||

|

|||||||

| Also

for the first time, two different models will wear the bras and body

pieces. Adriana Lima and Alessandra Ambrosio will walk the runway

in them for the 2014 Victoria's Secret Fashion Show. Mouaward also designed last year's Fantasy bra and matching belt, which were adorned with more than 4,200 precious gems, including rubies diamonds, and yellow sapphires. The 18 karat gold bra, valued at $10 million, also featured a 52-carat pear-shaped ruby. |

|||||||

|

|||||||

|

|||||||

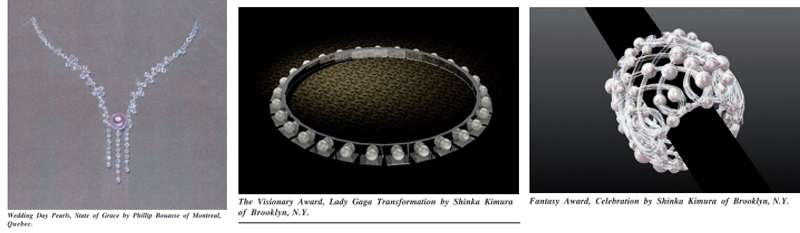

The massive development of Zimbabwe’s natural diamond resources,

which would ensure that they will continue to generate growth and

development over the long term, requires international cooperation

and investment. Such is the nature of our industry today and the

business world in general. But there should be Clb_]0 President

Gaetano Cavalieri delivers a speech at the s Zimbabwe Diamond Conference

prospect of substantial and continuing rough production in a market,

where over the next two demand is forecast to outpace supply Bain & Co has estimated that demand for diamonds will expand by 6 4 percent in termst annually over the next decade, while roughd supply from known sources will only gro compound annual rate of 2 percent This irresistible business prospect which is good Zimbabwe It is imperative, therefore, that the that was nurtured with the Kimberley Process and the agreements that were reached are by Zimbabwe s future as an important enhanced if it is seen to be an active campaign to ensure that diamonds are not a con?ict, but rather a source of growth and prosperity In the modern business environment independence is not the opposite of interdependence Indeed none of us can without the support and cooperation of the fortunes are interlinked, as are our interes chances for success But the stakes are not al the same Throughout much of the world, d1 considered luxury products, which are but not essential However, in a number among them Zimbabwe, the diamond essential business sector What this means roducin countries must remain keenl sentiments and concerns in all the because the prospect of losing their be most severe. This does not mean that you should to the consumer markets, nor does it no shorta e of interested arties Zimbabwe 01 UHUIIOIIIZ D'0lll'S€S Centre Authnnty Diamond Exchange. considerations should not be afforded equal The days 1n which terms could be dictated to by a handful of individuals, companies or are long over Today Africa is not to the diamond pipeline, it 1S the pipeline s This continent no longer can be considered whose primary role 1S to produce raw materials processed and sold elsewhere The recent of De Beers diamond trading headquarters to Gaborone was an event of historic for it shifted the decision-making capacity diamond business from Euro e to Afnca I strongly believe that the Kimberley Process, and f discussions that we had with Zimbabwe, to the remarkable change that has taken recent years Just as I feel that the African became more closely aware of consumer 1n the developed markets, I believe that from consuming countries came to and respect the expectations that Africans their natural resources In recent years I have been very actively involved of both physical and business for the industry in Latin America, which 1S establishing itself as a region of tremendous potential Although it 1S a very significant of gold silver and gemstones, Latin America to the same degree with diamond resources are in Afnca. It also has lacked a properly structured trading centre, which is what we are building in Panama, which is today home to the Panama Diamond Exchange, the region's only diamond bourse that both recognized by and is a member of the World Federation of Diamond Bourses. The project involves the construction of a $200 million trading complex in Panama City, called the Panama Gem & Jewelry Center, which will serve as the gateway to Latin America and the trading hub for industry professionals from Mexico in the north to the southem tip of South America. As part of the process, I worked together with the Panama government in its becoming a member of the Kimberley Process, which is of course an absolute prerequisite in the business today. In Panama, we set up the diamond exchange as the foundation of the new regional trading centre. It is a body that helps facilitate and regulate the trade, and, when accepted as member the World Federation of Diamond Bourses, provides members of the worldwide industry a physical venue in which they feel comfortable doing business. I know that the Zimbabwe Government has been considering setting up a diamond exchange in this country. It is a move that I recommend be considered very seriously. There was a time, not that long ago, when the world’s diamond markets did not extend far beyond Western Europe and North America. Today they are global, and the two most exciting prospective regions are most probably Africa and Latin America. I am most proud to be associated with both them, and to have played a role in their development. |

|||||||

| International

Pearl Design Contest By Jenniter Heebner |

|||||||

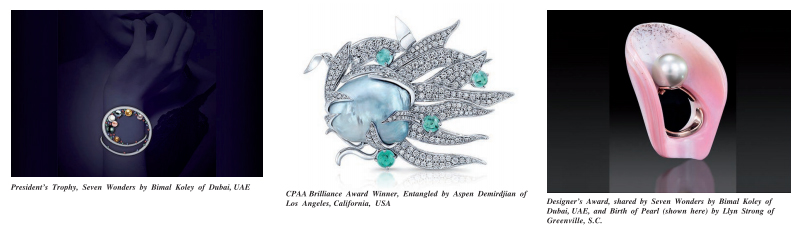

The winners of the 2014-2015 International Pearl Design Competition

have been announced. This year marks the fifth annual International

Pearl Design Competition organized by the Cultured Pearl Association

of America, a nonprofit group aiming to drive awareness to pearls

in the marketplace. The President's Traphy is awarded to a design that unanimously captivated judges as the best of the best. |

|||||||

|

|||||||

The Luster Award is given to the most mrketplace pearl design for

a retailer. The Designer's Award is given to the entry that takes pearls to the far corners of the Imagination and beyond. The Brillance Award is given to the best Illustration of the spectrum of pearl colours. The Orient Award is given to the most compelling design that will inspire a new affinity for pearls. The Visionary Award is given to an artist who redefines the iconic pearl strand and shifts the perception of pearls for today's buyer. |

|||||||

|

|||||||

| The Fashion Award

is given to a modern, fresh design that could be seen on a Paris runway. The Wedding Day Pearls award is given to a piece that speaks to a fantasy wedding theme, since brides and pearls go hand in hand. The Fantasy Award is given to a conceptual, aspirational design. |

|||||||

|

|||||||

| Judges Included Jill Newman, senior editor of the Robb Report, Cheryl Kremkow, director of Citrine Media, Jennifer Gandia of Greenwich Jewelers, Tanya Dukes, senior editor Instore and InDesign, and Jean Francois Bibet, workshop manager for Cartier. | |||||||

| Creating

a chain of Custody for Coloured Gemstones By Edward Boehm |

|||||||

|

|||||||

Mr

Edward Bochm |

|||||||

Compared to diamonds, coloured gemstones represent a much smaller

segment of the jewellery industry. They provide, however, a source

of income to a much broader range of social and economic strata

while at the some time they lack on industry-wide system to promote

ethical trade of rough gem material. This article explores a growing

list of initiatives aimed at making sure that miners of exquisite

coloured gemstones receive fair pay, health care and even a hearty

daily lunch. Coloured gemstones have enjoyed record-breaking auction prices due to a strong resurgence in demand over the post six years. Though coloured gemstone prices are not as easy to track, historically they tend to follow diamond and gold price Trends. Recently however, coloured gems have shown greater gainst than diamonds due to the dramatic drop in diamond demand coupled with overproduction at the beginning of the globdl recession in 2008. Gems have also outperformed gold as it has recently lost its lustre as a haven for hedging stock investments. Naturally, this trend has brought much more attention to coloured gemstones and their sources, as well as how they are mined, cut, and traded Unlike The diamond coloured gemstones do on industry-wide system promote eThicdl Trade gem mdTeridl. This is The fdcT ThdT mosT gemsTones ore difficulT becduse They ore mined scdle drTisdndI miners didmond mining concerns. In May of 2000, South African diamond producing countries intiated discussions become known as the process to stop the trade diamonds That could be used to finance rebels to undermine governments. |

|||||||

|

|||||||

In 2003, this process was implemented by several diamond-producing countries. has 54 members from 80 countries that represent approximately 99.8 percent of global diamond production. Essentially, seeks to provide a certification scheme by which supplier countries are required to meet strict guidelines to guarantee conflict-free diamonds Through greater transparency and exchange of detailed information related to mining, recovery and transportation of rough diamonds. However, in December 2011, international non-governmental organization Global Witness resigned as an official observer to protest what it called “blatant breaches" in compliance byseveral supplier member countries. Though serious challenges remain, the Kimberley Process has paved the way for greater transparency and sets an example for other mining sectors. Gemstone mining can be divided into large-scale, small- scale, and artisanal mining operations. For simplicity most organizations combine small—scale and artisanal into one category. According to The World Bank, “at least 20 million people engage in artisanal and small-scale mining and a further 100 million people epend on it for their livelihood. hese numbers are growing in line ith higher prices and demand for = inerals both in OECD countries nd emerging economies such as China and lndia." There are 47 primary coloured gemstone producing countries around the world. Approximately 20 percent of all coloured gemstones come from large-scale mining operations (LSM) while approximately 80 percent come from artisanal and small-scale mining operations (ASM). It is estimated that 90 percent of these ASM operations are located in developing and emerging countries. in comparison, approximately 10 percent of all diamonds come from ASM operations. The coloured gemstone industry has made numerous proposals for certification schemes but none have taken hold. in 2001 the World Bank launched an initiative called the Communities, Artisanal and Small- Scale Mining (CASM) declaring that “CASM’s holistic approach tosmall- scale mining aims to transform this activity from a source of conflict and poverty into a catalyst for economic growth and sustainable development." The keywords here are “sustainable development,” which point to the need forcreating working conditions and environmental practices that are sustainable for future generations to enjoy. if the goal is sustainability then most of the social, economic |

|||||||

|

|||||||

| entity formed In 2003 by One which operates a tanzanite mInIng In Merelani nearArusha A portion of all Its sales towardfundingthefoundation anzanite Foundation website that It IS dedicated to and promoting lt acts on behalf of all and socially responsible and partners In the Industry and Implements "' ods of practice The Foundation seeks er a ruly ethical route to In accordance with the Tanzanite Protocols Gemfields with de t resources IS a relative to gemstone mInIng lt publicly traded company with Interests In the Kagem mine In Zambia and a g venture TheIr global mIne— campaign promotes as well as fair and e and environmental TheIr website states dedication to presen/Ing environment nurturi local communities delIv t ‘ and upholding human rights remains paramount to our success." They also support the World Land Trust in providing support for conservation projects in Africa. Gemfields only sells rough material to its network of cutters around the globe. Belmont is a family-owned large-scale emerald mine that strives to not only meet but exceed strict new Brazilian environmental laws. Though their operation is considered large scale forcoloured gemstone mining, it is still relatively small when compared to large- scale diamond mining. T l High-pressure water, used for separating gem material from the ore, is recycled through an extensive natural filtration system. Soil and trees removed during the mining process are replaced as the land is prepared to be fully reclaimed to its original state. Miners are equipped with modern equipment and follow strict safety procedures. They also receive fair pay, health care and even a hearly daily lunch, which l had the pleasure to share with one of the shifts. So farthere are still only a few wholesalers who actively are pursuing fair and ethical trade | |||||||

|

|||||||

|

|||||||

|

|||||||

initiatives

but many are discussing how they should move forward. The lack of

a large-scale leader has made it difficult for the wholesalers to

organize a coordinated effort. There are a few largercompaniesliketheTanzanite

Foundation, Gemfields and Belmont that have set a positive example

that others will hopefully follow. A The Responsible Jewellery Council

(RJC) has a certification programme that sets standards for what

it deems are responsible business practices for companies in the

jewellery supply chain, ranging from mining to retail. Their initial

focus has been on the precious metals supply chain but they will

certainly branch out into other sectors as they become more relevant.

Their chain-of-custody standards require that the materials beconflict-freeasaminimum,and

responsibly produced. Momentum seems to be developing for a viable

mine-to- 80 Bangkok Gems & Jewellery market system ofsustainable

trade for coloured gemstones as more attention is directed at this

sector. However, the vast complexities associated with artisanal

small- scale miningwillcontinueto hinder progress. |

|||||||

|

|||||||

An efficient and fair system will require that all sectors of the industry be included in a transparent and inclusive manner. The development of such a system, that all levels of the supply chain will support, will be essential for its long-term success. in the meantime, miners, dealers and retailers should focus on providing any help to these communities in any way they can —-simple projects to help find water supplies, build schools, supply books, basic gemmological training, first aid provisions, mining equipment and safely instruction, mosquito netting, support land reclamation projects, etc. implementing these small projects will future depei well as ett generation rare and nature. Edvi and pre. Chattan compar collect< salesar consu gemn Switze hisgrc grad Gern Carc obtc dipl Inst '. ge ler the tutelage of Edward Boehm is the founder and president of RareSource in Chattanooga, Tennesse USA, a company specializing in fine and collectable gemstone, collection sales and acquisitions and museum job tionsandmuseum are le began his _ rub I studies in L id€ T do~ in geology and, l\/lir heUniversi1yofNorth ‘ ‘ rap apei Hill, and later T ope aduategemmoiogitr ‘ stag n the Gemological ~ ton nericaandacertified 4 mill ist title from the e con Ar 3em Society. He has cor wt ‘he Gubelin Gemlabin I Vin. Ll Switzerland, was ndlaboratory consultant Q Tao t ,andconsultedforUSAlD, . am; r a World Bank-sponsored “ . Detr to improve the gemstone F varie Madagascar. His current e in siz Jes him to mining localities the globe as a consultant yer. rese Mon dis c fasci of GIA. December and buyer. |

|||||||

| Montepuez Ruby Mining Operation, Mozambique | |||||||

|

|||||||

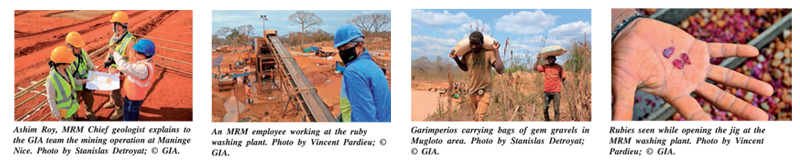

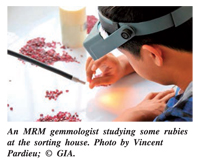

ln early September 2014, a team of GIA (Gemological Institute of

America) field researchers jouneyed to the Montepuez mining area

of Mozambique to collect ruby samples for the Institute's gem identification

database and to document the current state of the deposit. The Montepeuz

Ruby Mining Company (MRM) has rapidly expanded since the operation

reached the production stage in 2012, handling 1.6 million tons

of rock and recovering 8 million carats of ruby and corundum to

date. The GIA team, consisting of Andrew Lucas and Vincent Paradieu,

Gems & Gemology (G&G) Technical Editor Tao Hsu, videographer

Diadier Gruel and expedition guest Staniaias Detroyat, discovered

an ample variety of ruby specimens ranging in size, colour and iron

content. |

|||||||

This

is the third expedition GIA researches have made to the Montepeuz

ruby deposit since its discovery in 2009. "It is truly fascinating

to witness the evolution of this major deposit. While it is clear

from our exdedition that the MRM operation has reached production

stage, I believe that this is just the beginning. The deposit seems

to be increadibly rich, easy to mine and convenienly locted mine

and conveniently located along a major road and close to Mozambique's

port city of Pemba," said Paradieu. This

is the third expedition GIA researches have made to the Montepeuz

ruby deposit since its discovery in 2009. "It is truly fascinating

to witness the evolution of this major deposit. While it is clear

from our exdedition that the MRM operation has reached production

stage, I believe that this is just the beginning. The deposit seems

to be increadibly rich, easy to mine and convenienly locted mine

and conveniently located along a major road and close to Mozambique's

port city of Pemba," said Paradieu.Today, MRM employs 600 staff and consists of 4 pits, a sophisticated washing plant, a sorting facility using a proprietary ruby evaluation system, an extensive propection system and a base camp. Two types of deposits are found at the operations are found at the operation: at Maninge Nice, rubies are found in a primary deposit associated with amphibole, mica and feldspar, In Mugloto, Ntorro and Glass, rubies are found in secondary deposits along current or former river beds. The company is currently focusing mining production on secondary deposits in the Mugloto area since it is shadow (4-8 meters) and rich in high quality clean rubies, a result of weathering. Even though the mine is in production, exploration continues at a fast pace, with core drilling into primary deposits and auger drilling into secondary deposits. "This deposit will not only change the supply structure of ruby on the global market, but may also contribute to changing the way business is done in the ruby trade, " added Lucas. |

|||||||

| Tsavorite

Gains Recognition By Mark Lepage |

|||||||

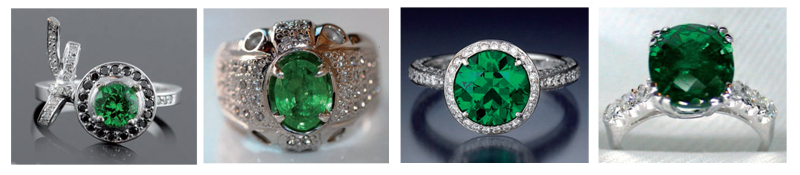

. "Tsavorite

is the purest and truest green of all the coloured gemstones, "says

Bruce Bridges, president of Bridges Tsavorite in Tucson, Arizona.

Unfortunately, It also has a bloody recent history. . A relatively new addition to the market, vivid green gemstone tsavorite was discovered in Kenya in 1967 by Scottish geologist and prospector Campbell R.Bridges, Bruce's father, After decades of mining the stone in East Africa, Bridges was ambushed and murdered by claim jumpers on August 11, 2009. |

|||||||

|

|||||||

. "A

well-known local gangster teamed up with two politicians who wanted

our mining concession and figured the best way to take it was to

kill us all, " says Bridges. He describes a gang of 35 to 40

attacked with knives, macheters, spears and other weapons. "I

survived, along with four other eyewithnesses. Tragically, the attack

was fatal to my father, " Bridges succeeded his father as president

of the company. A protracted court trial of the seven accused ringleaders

was scheduled for a September 29, 2014, summation, "and we've

been promised a ruling before the end of the year." Bridges

says. |

|||||||

|

|||||||

| Turning Green . Tsavorite's intense green is due to two trace elements: vanadium and chromuim, "They represent from 0.5 percent to 1.5 percent of the entire composition of the stone," says Raja Shah, president of wholesaler Color First in Tampa, Florida, which specializes in East African stones Tsavorite isn't the only green garnet, Demantoid garnet is also green, but the two stones are different, Tsavorite is from the grossular family of garnet, a calcium aluminum sillicate, with a hardness of 7.5 on the Mohs scale. That makes it very durable for jewellery that can be worn every day. Demantoid is from the andradite family of garnet, a calcium iron silicate, and is softer, a 6.2 on the Mohs Scale. . The two stones also differ in price. While value estimates vary, all dealers agree that demantoid is more expensive, with 10-carat-plus stones piced at about $30,000 per carat. "A tsavorite that's 5 carats-plus and fine quality will be priced at $9,000 to $10,000 per carat, " says adam J Gil, vice-president of Jerry Gil & Co., and the third generation of the New York City wholesaler. Bridges vasily prefers tsavorite. "I've seen $50,000-per-carat demantoid and I'll beat that colour with tsavorite for a quarter of the price" |

|||||||

|

|||||||

. Tsavorite's also compares favorably with emeralds. "A nice Colombian emerald would still be five to ten times the price of tsavorite ," says Shah, Gil asserts "Tsavorite shouldn't be considered a step down from emerald it's a beautiful stone " in its own right. . Shah also points to "controvesy over emrald treatments, which sent some people looking for alternative green stones, " Why tsavorite? "It's completely untreated. It comes out as nature intended. There's usually a little bit of inclusion, which is okay, as long as it doesn't detract from the stone's beauty. " says Shar. Tsavorite has twice the disperision of emerald , making it appears brighter . Boyle adds, "More than once or twice, I've read articles in the trade press about tests conducted with people rating the gemstones for colour without knowing which was which, and tsavorite always won over emeralds." |

|||||||

| . Although still a comparative bargain, "Prices have really skyrocketed recently," says Gil. "In the past five years value has tripled or quadrupled," The increase in prices "has been a long time coming," says Shar. It's risen for siveral reasons. "Very few people were famillar with tsavorite, given most people associate garnet with red. And It was only discovered 5o years ago, whereas emeralds have 5,000 years of history, "Shar adds. | |||||||

Television Show-Off Boyle also credits JTV's "television sales, a long-form infomercial. If you will, that allows us to inform people about the stone and show off its beauty. That's helped to popularize the stone." Asian market demand has also raised prices, "Especially in the past three years. China happened - the Chinese started buying it and have driven demand, "says Shah. That Increased demand raises prices because of the rarity of the stone. "Tsavorite is 1,000 percent rarer than emeralds," says Bridges "And as its size gets larger - anything 3 carats and up - the rarity increased exponentially" |

|||||||

Tsavorite is likely to remain rare. In supply terms. Ongoing mine-related violence and death threats mean the Bridges mines, and most others in Kenya, are shut down. That, combined with limited, sporadic production in Tanzania, means there is very little new material. "My father loved the romance and magic of mining gemstones, "concludes Bridges. "He didn't really like to sell gems. He stockpilled a great deal. SO we have been cutting and selling material that had been stocked up for decades." |

|||||||

C

o p y r i g h t © 2 0 0 0 - 2 0 1 6 D4U

WEB TM A l l

R i g h t s R e s e r v e d |