| Peregrine Diamonds reports "encouraging colours" | ||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

|

||||||||||||||||||||||||

| x |

”The Rapaport Group calls on all ethical

members of the diamond trade to cease and desist

from the trading of Marange diamonds. In the event

that firms insist on buying and producing them we

demand that these Marange diamonds be

separated from non-Marange diamonds so that

they are not sold to U.S., EU or U.K. entities. We

firmly believe that the mixing of Marange diamonds

with non-Marange diamonds and their subsequent

sale to U.S., EU or U.K. entities without disclosure is

unethical and illegal. We demand that firms selling

Marange diamonds do so with full disclosure, similar to the disclosure requirements for treated diamonds. ”RapNet - Rapaport Diamond Trading Network — continues to ban the trading of any diamonds sourced from Marange, Zimbabwe even if such diamonds have KP certification. Members found to have knowingly offered Marange diamonds for sale on RapNet will be expelled and their names will be publicly communicated. RapNet will be publishing new trading rules and ethical guidelines in the near future. ”The Rapaport Group warns the diamond trade that continued sourcing and legitimization of diamonds involved in human rights abuses threatens the integrity and reputation of all diamonds. Diamond trade organizations particularly those promoting responsible trade and those serving in the U.S., EU and U.K. trade should immediately issue clear guidelines banning all their members from trading Marange diamonds. We believe it is unethical for trade organizations to refrain from clearly banning the trade in illegal Marange diamonds under the guise of supporting the KP.” |

x | ||||||||||||||||||||||

| Rare gems at Dupuis' Toronto sale | ||||||||||||||||||||||||

A highlight of Dupuis’ Fall Sale of Fine Jewels

was a ring containing a very rare ruby of 7.62 carats. The stone, with a pre-sale estimate of

$350,000-$400,000, was sent to the Gubelin Lab in

Switzerland for examination and the report indicates

Burmese origin with “pigeon blood red” natural

colour. The catalogue cover piece is a 1920s ring set

with a 5.19 carat diamond of fancy vivid yellow, VS-

1 clarity. Among the other treasures is a very rare

0.98 carat fancy blue, VS-1, diamond ring; an

exquisite pair of natural pearl ear pendants; a

diamond ring by Gubelin set with a 4.18 carat

diamond of D colour and VVS-1 clarity. Dupuis Fine Jewellery Auctioneers was established by Ron Dupuis in 1986. Based in Toronto, Canada - but renowned both nationally and internationally - Dupuis and his team have made history over the past 25 years by selling jewels totalling more than $50,000,000. Dupuis has set the standard in Canada with its leading edge cataloguing style, user-friendly website and iPhone App. Each auction is broadcast live over the internet. The firm dominates the jewellery auction market in Canada with over 80% of market share by value of published Sale Results. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

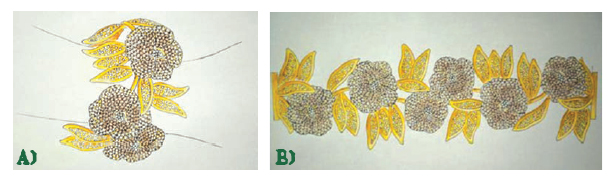

| A) An Art Deco 13.68 Carat Sapphire and Diamond Clip, Cartier, Circa

1925, estimate $70,000-$90,000. B) A Pigeon Blood Red 7.62 Carat Ruby Ring, estimate $350,000- $400,000. C) A Vivid Yellow 5.19 Carat Diamond Ring, circa 1920, estimate $60,000-$75,000. |

||||||||||||||||||||||||

The Property of HM Queen Elena of Italy and Her Descendants comprises 27 lots (lot 207-233) and is led by a finely pierced 1920s diamond bracelet, with a stunning floral motif, by Alfredo Ravasco. Ravasco created jewellery for the Royal House of Savoy, including presentation brooches for the Princess of Piedmont, later Queen Maria Jose of Italy. He was one of the few Italian jewellers to exhibit at the 1925 Exposition Internationale des Arts Decoratifs in Paris. Always a highlight of the sale, the regular Cartier section features over 50 lots, from jewels and cufflinks to watches, clocks and accessories. Jewellery highlights include a bold Art Deco panelled bracelet set with large circular cut diamonds, which epitomises the strong geometric design so sought after from this period, an attractive emerald and diamond bracelet mounted by Cartier in the 1950s, and a modern 'C' necklace, which is sold to benefit Iran's Children's charity. The finesse of Cartier cufflinks is demonstrated by a pair which is diamond-set and semi-circular in design; those featured in a refined emerald dress-set and a pair of emerald semi-circular gold cufflinks from the Property of HM Queen Elena of Italy and Her Descendants. Providing a veritable treasure trove of options for the discerning entleman, the selection of cufflinks-by other houses - continues throughout the sale, and includes an antique pair made of rock crystal and decorated with game bird paintings. |

||||||||||||||||||||||||

| U.S. jewellery market pushed ahead, but changes taking place | ||||||||||||||||||||||||

Is the American jewellery-buying public ahead

of the curve compared to general consumer buying?

Despite the country’s ongoing economic ills, with

obstinately high unemployment and a housing market

still in a state of disarray, U.S. consumers have been

increasing their purchases of jewellery for most of this

year. Indeed, whereas the American market has been underperforming Asia in other areas, when it comes to jewellery it is doing a better job of keeping pace. According to U.S. government figures, jewellery store sales for September jumped 14.6 percent on the year in the first three-quarters of 2011. And, while it is still early days yet, reports from the jewellery sector following the critical Thanksgiving Day weekend, which is traditionally regarded as the start of the Christmas shopping season in the United States, have been almost universally upbeat. In general, the mood of the American retail market is better than it has been in a while. Led by discretionary purchases, sales in October increased by 0.7 percent from September and by 4.7 percent over last October, the National Retail Federation said. However, the strong rise could have been due to early holiday promotions. “Retailers’ seemed to strike the right chord with shoppers last month,” said National Retail Federation President and CEO Matthew Shay. “Knowing the economy is still a big factor in customers’ shopping decisions, retailers will continue to offer great deals and exceptional value throughout the holiday season.” And the widely watched U.S. Conference Board Consumer Confidence Index, which had declined in October, showed an improvement in November, rising to 56.0 from 40.9 in October. The Present Situation Index and the Expectations Index both rose. “Confidence has bounced back to levels last seen during the summer,” said Lynn Franco, Director of The Conference Board Consumer Research Center. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

| A) Mr. Matthew Shay B) Mr Ken Gassman | ||||||||||||||||||||||||

“Consumers’ assessment of current conditions

finally improved, after six months of steady declines.

Consumers’ apprehension regarding the short-term

outlook for business conditions, jobs and income

prospects eased considerably. Consumers appear to be entering the holiday season in better spirits, though overall readings remain historically weak,” Franco added. What’s behind the rising sales in the U.S. market? According to noted diamond jewellery analyst Ken Gassman, one should look past the once-declining consumer confidence index or the fact that the American political system is deadlocked. “I say, ignore those factors,” Gassman said. “Unemployment is still high and the housing market is still very bad, but it is amazing that these factors do not seem to matter. They simply do not correlate to consumer sales. You would think that when times are bad, sales would also drop sharply, but that is not the case.” “There is a wellknown expression that when the going gets tough, people go shopping. Frankly, it is that simple. As far as jewellery is concerned, people are shifting money from other categories in order to give themselves a treat. After going through a tough period over the last three years, people want to reward themselves with something special. Americans are born to shop, and although there has been a slowdown in the past few years, the basic consumer mentality has remained in place,” he added. Gassman said that data from the U.S. Commerce Department showed that sales of jewellery were up 14.6 percent in the year to September despite rising prices for precious metals, while sales measured in dollar terms were up 12 percent. However, he believes a rise in the mid-to-high single-digit range seems more likely. “Over the next couple of years, I estimate that rises in jewellery sales gains will be around 4 percent annually,” Gassman said. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Up-market jeweller Tiffany & Co. reported a 63-percent rise in fiscal third-quarter earnings, with solid

sales growth in each of its eographic regions. Tiffany

reported a profit of $89.7 million for the quarter ended

October 31, up from $55.1 million from a year earlier.

Sales surged 21 percent to $821.8 million, or 17 percent

when stripping out currency fluctuations. Total samestore

sales soared 16 percent excluding currency

fluctuations, compared with a 7 percent rise last year.

Meanwhile, sales soared 24 percent at the company’s

Fifth Avenue flagship store in Manhattan, boosted by

the record number of tourists visiting New York. Tiffany has posted double-digit rises in profits in each quarter this year. In addition, same-store sales have been stronger than those its mid-range competitors with its consumers more willing and able to spend on gifts and other discretionary purchases. The firm reported a 17-percent increase in sales growth in the Americas, which accounted for most of the total sales. Further evidence of the rising strength of U.S. jewellery sales is seen in the financial turnaround at retail giant Zale Corp which operates more than 1,800 stores in North America. Indeed, the firm’s stock jumped close to 23 percent on one day in late September after Chief Financial Officer Matt Appel gave investors reassurance that its three-year turnaround program was working. Appel said that Zale was “trending in the right direction,” aided by the replacement of underperforming staff, rising revenue at stores open at least a year, and partnerships with celebrities such as Vera Wang and Jessica Simpson on exclusive product lines. The current situation is a large improvement on the decline the company underwent following the onset of the global financial crisis exactly three years ago. Zale Corp’s revenue figures slumped during the recession of 2009, hit by consumers slashing nonessential spending, difficult credit conditions as banks reduced their lending, and high unemployment. It has closed hundreds of stores over the past two years and moved top management around, as well as letting some go, as part of its turnaround program. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

In the latest results, for its fiscal fourth quarter,

which it reported in late August, the chain posted an

increase in sales in its fiscal fourth quarter of 9.4 percent

from the same period of last year to $377.3 million. The

retailer said that same-store sales, an important pointerfor the direction of retailers, rose by 9.8 percent. The

company said that the fourth quarter was the third

consecutive three-month period of positive same store

sales. For the fiscal year 2011, Zale posted a 7.9-

percent increase in revenue to $1.74 billion. Also in the mid-range of the U.S. jewellery market, Signet Jewelers, the world’s largest specialty retailer of fine jewellery, reported that third-quarter sales jumped 10.7 percent on the year to $710.5 million. The jeweller’s results were boosted by a 10.6-percent increase in same store sales. Meanwhile, pre-tax income for the period ended October 29 was $42.1 million, up from $12 million for the third quarter of last year. Significantly, the company, which runs around 1,860 retail jewellery stores in the United States and Britain, said its third-quarter results were bolstered by U.S. sales, while its U.K. sales were more or less unchanged on the year. The company’s approximately 1,324 stores in the United States account for about 80 percent of annual sales, and posted a 13.3-percent rise in sales in the quarter to $563 million. Meanwhile, same store sales jumped 13.9 percent. Some analysts believe that reports of the decline of the U.S. jewellery market have been exaggerated. “It is true the United States’ share of the global jewellery market has fallen to around 40 percent from its long-time 50-percent share, but it remains the most important market in the world,” said James Porte, of the Porte Marketing Group. “In addition to discretionary spending on jewellery, there are 2.4 million weddings a year in the United States and 1.9 million engagement rings are sold,” he said. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

| G) Mr. James Porte | ||||||||||||||||||||||||

As for the general U.S. jewellery market, the

boost in jewellery purchases could be coming from

middle-level income earners making at least $100,000

who are feeling better about the economy and the super

rich, according to research firm Ipsos Mendelsohn. A study by the company based on interviews with more than 2,000 affluent people and 1,000 non-affluents over two months found that their consumer optimism was strong. But not all the news was good, as least from the jewellery sector’s perspective. The Ipsos Mendelsohn study also found that the consumer’s idea of what a luxury purchase was is changing and is highly subjective, with a two-hour massage, or a facial in a spa frequently fitting the bill. In other words, consumers are lowering the luxury bar, with many items far cheaper than jewellery fitting the bill. “That is a new component in the evolution of luxury,” the report said. Although traditional luxury brands were cited, such as Cartier, Louis Vuitton, and Patek Philippe, respondents also said luxury was less an issue of price than an experience, which could mean chocolate truffles, a fancy coffee machine, or imported cheese. Testimony of the changing nature of what constitutes a luxury product was provided by two-thirds of affluent respondents saying they define luxury differently today than they did even five years ago. In addition, affluent consumers do not believe that value pricing hurts a luxury brand. Among affluent people, 90 percent of affluents admitted to going out of their way to find the best price. “Fewer than half said true luxury is worth any additional cost and fewer than half also said true luxury does not go on sale, and even fewer said when a luxury product goes on it sale it lessens the perception of luxury. So consumers are bringing a very strong value orientation even to highest-ticket items.” “There is a strong sense that luxury is not stereotypical, but personal. Back in 2005 or 2006, there was a more shared sense of what luxury is, but today it’s much more personal and idiosyncratic. It’s about a feeling of ‘I deserve’ more than anything. And rarely were they talking about how it appears to others; it’s much more about self-gratification.” |

||||||||||||||||||||||||

| February Bangkok Gems & Jewelry Fair Rising to even greater heights | ||||||||||||||||||||||||

The Thai Gem and Jewelry

Traders Association (TGJTA) wants

all prospective international

exhibitors and visitors to the

upcoming 49th Bangkok Gems &

Jewelry Fair (BGJF) to be assured

that the fair is ready to open on

schedule. The BGJF Organizing

Committee has ushered in

preparations, and are confident that

all facilities will be more than ready

to receive international exhibitors

and visitors at the fair in February

2012. The BGJF49 is scheduled to be held from February 9th to 13th, 2012 in the Challenger Hall of Impact Exhibition Center, Thailand’s largest exhibition facility. Currently, pre-registration is available and the TGJTA is ready to provide any and all possible assistance to international exhibitors and visitors. Mr Somchai Phornchindarak, President of the TGJTA, states: “Unlike several other industries and industrial estates, the Thai gems and jewellery industry is overall very fortunate to have been unaffected by the floods. The Impact Exhibition Center, venue of the biannual BGJF, as well as the Suvarnabhumi International Airport, are fully operational. Both areas are untouched by the flooding.” |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

The Thai Gem and Jewelry Traders Association has issued the

following statement: “The Thai

gems and jewellery industry has

been most fortunate in avoiding

major impacts from the current

flooding that has struck several

central Thai provinces. Although

some parts of Bangkok have been

affected, we have been very

fortunate during the past several

weeks.” The major manufacturing base of the Thai gems and jewellery industry is located in inner Bangkok and in eastern provinces such as Chanthaburi, which today remain completely unaffected by floods. Mr Somchai emphasizes that the Thai gems and jewellery industry is committed to stepping up activity as major supporters during this difficult time, ensuring that Thailand’s exports remain as high as possible. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

Mr Wisut Ittipornvanich, CEO

of the BGJF, further assures foreign

buyers and exhibitors that the

TGJTA is making extra efforts to ensure that the BGJF49 is more

ready than ever. “As flood problems

pose several challenges for us, we

have exerted our greatest effort in

preparing for the BGJF49, and I am

happy to report that fair preparations

are now almost complete,” states

Mr Wisut. “As the BGJF is held

twice a year, the TGJTA is very

experienced in preparing for each

and every fair. Urgent meetings

have been held with all important

components of the exhibition centre,

including security, logistics and

airport customs.” According to direct mail and telephone surveys to many previous visitors to the Bangkok Gems & Jewelry Fair, 96 percent of buyers would like to buy the same or more gems and jewellery from Thailand. These buyers also stated that Thailand offers good quality, wide varieties of designs, and competitive prices of gems and jewellery. More than 300 buyers who used the BGJF Business Matching Service at BGJF 48 were surveyed, and 64 of those buyers and were completely satisfied with the service. These buyers purchased gems and jewellery from Thailand within the range of US$30,000 to US$2 million while on their sourcing trip to Bangkok. This Business Matching Service is now open to buyers who plan to attend theBGJF49 in February 2012. |

||||||||||||||||||||||||

| Rio Tinto Diamonds Announces Winners of Global Design Competition | ||||||||||||||||||||||||

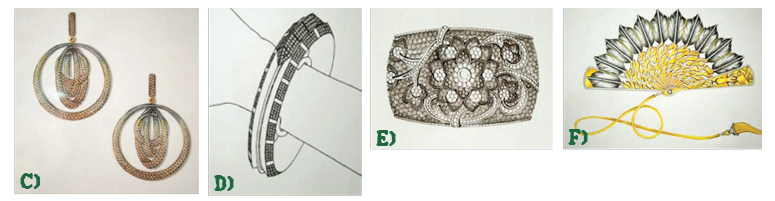

Rio Tinto Diamonds has announced the winners of its Global Design Competition, awarded by an elate panel of eight judges from the fashion and jewellery industries. The judging panel, at an event at the Kristin Hanson Gallery, selected nine winners from a record number of entries from the US, Canada, Australia, India, China and Hong Kong, across four categories of jewellery design: Champagne, Silvermist, Canadian Diamonds and Sustainable Jewellery. According to jewellery judge and style editor Mr Michael O' Cornor, "I was extremely impressed with how each of the designers intrepreted the challenge and came up with unique and beautiful jewellery pieces that highlight the use of Rio Tinto's diverse diamonds portfolio," The judging panel also refered to the Incredible variety of designs, from classic pieces through to contempoary interpretations, often with nature and the elements as the source of inspiration. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

C) Champagne Diamonds Master Craftsman- Nejal Rajesh Mehta, India "The World of Champagne" earrings feature pave set champagne diamonds in a captivating gradient of colour. D) Silvermist Diamonds TM Master Craftman-Dean Walker, Australia The "Silvermist Express" bangle was inspired by a desire to create something that will inspire hope. This 18K white gold bangle appears to float around the wrist of the wearer. The "train", adorned with striking Silvermist diamonds, moves on its track also made with Silvermist diamonds. E) Silvermist Diamonds TM Master Craftman- Joseph Weinreich, USA The "Nature's Beauty" flower cuff is encrusted in Silvermist Diamonds TM,, symbolizing this gift from Mother Natureand featuring a pearl in its centre. F) Sunstainable Jewellery Master Craftman-Nadia Neuman, Australia The "Tyger, Tyger" fan melds together functionality and luxury all from a sustainable perpective. In addition to using 100% sustainable materials in the design, the tiger motif represents nature as an endangered creative and reminds its user of the need to care for the earth. |

||||||||||||||||||||||||

|

||||||||||||||||||||||||

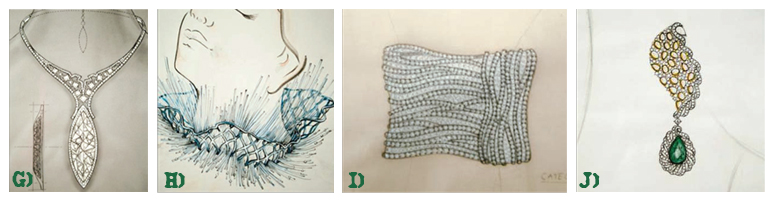

G) Canadian Diamonds Master Craftman-Reena Ahluwalia, Canada The "Canae" Canadian Diamond necklace is inspired by the poetic image of a magical Canadian landscape - a canoe in an icy, crystalline frozen lake. The Canoe is known as a carrier of Canadian myths, a symbol that represent voyage, discovery, harmony with nature, and courage. H) Sunstainable Jewellery Rising Star-V.Saravanan, India "The Creator" necklace is a true homage to nature. Utilizing recycled materials such as plastic toothplate tubes and mixing in the natural beauty of Silvermist Diamonds TM, this design uses a mesh design to remind people to protect the earth and nature and find ways to recycle plastic materials. I) Silvermist Diamonds Rising Star-Vijayshree Sovani, India This Silvermist Diamond TM bracelet is inspired by the ripples in desert sand as well as the winds of times. It is set in white gold with black whodium accents. J) Silvermist Diamonds Rising Star-Michelle Buxani, Temptations, Hong Kog "Rain Dance" earrings featuring Canadian Diamonds are set in white gold with yellowgold accents. This design was inspired by the sun shining through the clounds after rain, with rays of light hitting the water. |

||||||||||||||||||||||||

Rebecca Foerster, Manager of Rio Tinto Diamonds' US Representative Office, commented on the results, "We were delighted with the level of interest in the competition from all over the world and we look forward to working with the winning designers to showcase their creativity". As a result of their efforts, the nine winning designers will have many opportunities for significant exposure to the US jewellery industry, including their designs being showcased at a suite at the 2012 Academy Awards. Rio Tinto is one of the world's major diamond producers through its 100 per cent control of the Argyle mine in Australia, 60 per cent of the Diavik mine in Canada, a 78 per cent interest in the Murowa mine in Zimbabwe. These three mines allow Rio Tinto to produce diamonds for all market segments. Rio Tinto also has an advanced diamond project in India. |

||||||||||||||||||||||||

|

|||||||