|

||||||||||||||||||||||||||||||||

|

| Pakistan's Gemstones Can They Help The National Economy? | ||||||

|

Kashmir - also known as heaven on earth, holds in its bosom vast stores of precious & semi precious gems.

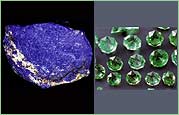

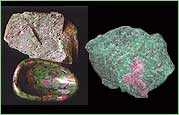

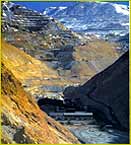

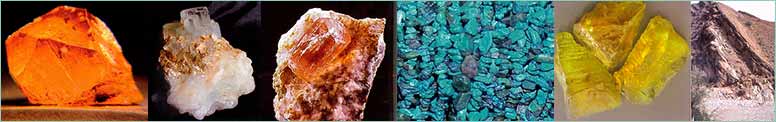

The two buzzwords when it comes to diamonds these days are beneficiation and conflict. Although the same terms are not applied to other gems, the story is more or less the same. Mining and beneficiation are done countries apart and in some cases, literally continents apart. Coloured gems too have played their role in funding conflict, for e.g. Afghanistan's emeralds during the country' s long and disastrous civil war that finally saw the emergence of the Taliban regime. Luxuries though they may be, gemstones are coveted and as such, they have value and power -like a double edged sword - to build or destroy and like diamonds in Southern Africa, coloured stones in Pakistan can be used to contribute to the national economy in ways that will be significant for its future generations. To start with, Pakistan is an impoverished and underdeveloped country that lacks natural resources apart from extensive natural gas reserves and limited petroleum. Other reserves are basically poor quality coal, iron ore, copper, salt and limestone. There is however, onenatural resource that while it may not! count for much in terms of bulk, can] add to the nation's economy -| gemstones. Pakistan shares 2,430 kms of its border area with Afghanistan and naturally, there are similar minerals found in its soil too. The northern and north western parts of Pakistan are surrounded by three of the mightiest mountain ranges in the world - the Himalayas, the Hindukush and the Karakorum. These mountains hide in their bosom all kinds of precious minerals like aquamarine, emeralds, rubies, topaz, peridots, tourmalines, amethyst, morganite, moonstone, lapis lazuli, kunzite, turquoise, zoisite, spinel, sphene and almost all the known varieties of quartz among others. Green Topaz. |

|||||

|

||||||

|

||||||

|

The main gemstone producing regions are Swat for emeralds, many varieties of quartz and epidote, Dirfoi corundum and quartz, Manshera for corundum and smoky quartz, Kohistan for peridot and Peshawar district for quartz. There are the federally administered tribal areas that yield gems like emeralds, garnets, all kinds of common and rare quartz, sphene, and epidote among others. The northern areas conceal a wealth of aquamarine, diopside, zircon, rutile quartz, tourmaline, topaz (golden and white), emeralds, rubies, spinel, quartz, amethyst, garnets, morganite, apatite, zoisite, sphene, and some rare earth minerals. Not only that, the porous nature of its border with Afghanistan has meant that for many decades, all kinds of Afghan minerals enter the country and are actually traded from Peshawar. In fact, since to the Soviet invasion of Afghanistan in 1979, Peshawar has become the market for Afghan gemstones. Prior to the invasion, it |l was the city of Karachi in the province of Sindh that hosted the main gemstone market. |

||||||

|

||||||

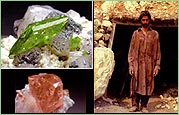

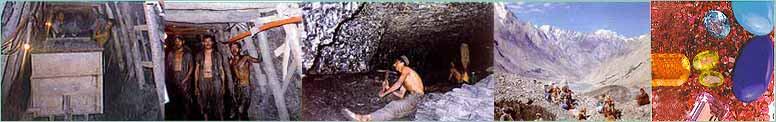

1 Antiquated mining practices result in as much rough being itstroyed within the ground as is extracted. , Emerald The problem is that most of these gems enter the country illegally or rather through areas where the arm of the law cannot reach. Pakistan's North West Frontier Province (NWFP), especially in the border areas are home to many different tribes that are effectively ruled by their own tribal leaders and follow their own laws. They are also the people who mine most of these precious gems and their methods are dangerous to put it mildly. The favoured method is to blast the rocks with explosives and then remove the gemstones from the exposed rock face and rubble. Not only is this method hazardous in the extreme, but also it reduces the size and quality of the gemstones being mined as quite a few are shattered within their host rock. The government of Pakistan has made efforts to regulate the sector and bring the gemstone trade into its mainstream economy. To this effect, the government set up the Gemstones Corporation of Pakistan in 1979 with the main purpose of exploring the nation' s mineral wealth and facilitating the extraction and trading of the gems as well. It may have had some valuable influence on the miners but that effect remained marginal at best and finally recognising its lack of effectiveness, the government liquidated the corporation in 1997. |

||||||

|

||||||

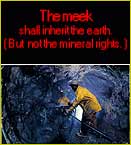

In many areas, the tribal people insist on digging themselves for the gemstones. Lacking sufficient mining experience and proper equipment, they often fail to reap the full profit of their finds. Currently there are two bodies now working in this sector - the Export Promotion Bureau of Pakistan (EPB) and the All Pakistan Commercial Exporters Association of Rough & Unpolished Precious & Semi Precious Stones (APCEA). In 1994, an annual trade fair, the Pakistan Gems & Minerals Show was also instituted to be held annually every October in Peshawar but unfortunately, the event can hardly be called a success. There are few exhibitors and precious few buyers, and this in a country, which if its mineral resources are properly exploited, can rival Brazil and quite a few African nations as a gemstone producer and this fact is nothing if not a tragedy for a nation whose economy is still struggling and around 30% of whose population lives below the poverty line. |

||||||

|

||||||

In 2003, the Ministry of Petroleum and Natural Resources conducted a study on the Strategy of Mining, Cutting, Polishing and Marketing of Gemstones in Pakistan. The study revealed that although the country has been regularly supplying the international gemstone market with a variety of precious and semi precious gemstones, only a handful are actually marketed as being of Pakistani origin. The study reveals that with the liquidation of the Gemstone Corporation of Pakistan, with the exception of two significant deposit in Azad Jammu & Kashmir (AJ&Ki all the identified gem deposits in th nation have been leased out to the private sector. This is the status of the major deposits. There are no statistics available for the small scale miniiv that is carried out, most of it illegally, in the NWFP, AJ&K, and the Northern Areas. |

||||||

|

While Pakistan does produce some jewellery for export, the industry is still nascent, to put it kindly. A lot of effort by the Government is required before it can even be considered a proper centre. The government of NWFP has auctioned off almost all of its identified precious stone deposits and since most of the leases have been acquired by novices, their inadequate mining experience and the scarcity of capital has ceased the commercial exploitation of a large number of these deposits. |

|||||

|

Garnet In the case of the Kohistan peridot, which is mainly located in unsettled areas over which the provincial government has almost no control, it is prey to local miners who employ the most rudimentary techniques on small deposits at high altitudes. Unscientific mining and high production has resulted in the drastic depreciation of the once highly sought Pakistani peridot. It is the same story with the aquamarine found in the Northern Areas. Leases have been granted to inexperienced people and they are destroying more than they extract. |

|||||

|

Tourmaline The study identifies the main hurdles that stand in the way of progress for the gemstone sector in Pakistan. The list includes the lack of patronisation by the Provincial Governments to develop mining, cutting and polishing as a cottage industry and indicts the lack of a conducive and effective regulatory and institutional framework that could guide the development of this sector. |

|||||

|

Illicit mining, lack of infrastructure in the mining areas as well the use of unscientific methods of extraction combined with the lack of skilled labour, inadequate finance, lack of marketing strategy, non availability of lapidary equipment, inadequate promotional activities and lack of human resource development. In short, basically they lack everything but the mine itself. It is not going to be an easy ride to do something concrete to ensure development for the Pakistani gem mining industry. |

|||||

|

The study frames a strategy that it feels will provide an efficient programme for development. It recommends a maintaining a sustainable supply of gemstones to the market, without any direct involvement by the government; creating a mining culture and small scale industry in the gemstone bearing areas; build a pool of skilled human resources especially in the areas of mining and marketing. It also suggests that the government assists the private sector in developing lapidaries as a cottage industry; regulate illegal mining activities. It also makes a recommendation that is quite ludicrous given the current circumstances and that is for the government to provide a special package of fiscal incentives to compete with the developed lapidary industry of neighbouring countries (i.e. India). The suggestion is so ridiculous that it does not even invite comment, However, its last proposal that the government work to make gemstones a substantial source of foreign exchange earnings for the cash strapped country makes sense and is well in the realm of the possible. |

||||||

|

||||||

|

Scarcity of financial and technological infill and lack of mining experience has led to tin closure of many small scale mines even though their resources are not entirely depleted. ,Moonstone , Ruby , |

||||||

|

In fact, the Ministry of Petroleum and Natural Resources has tried hard and has proved to be spectacularly unsuccessful in recruiting foreign investment and expertise in mining gems. Influential foreign institutes or corporations have given Pakistan a wide berth for a number of reasons. One is the reputation for unreliability of survey/analysis reports undertaken by the government sponsored institutions. Then there is the problem of security and many of the mines do fall in areas where the provincial governments exercise little control. Where marketing gemstones is concerned, one of the world's largest markets is just east of its border -India. In fact, at the four day Pakistan Gems & Mineral Show 2005 in Peshawar, which is jointly organised by the EPB and APCEA, a senior EPB official pointed out that Pakistan' s gemstone exports could be increased manifold if the government opened the door to Indian buyers. Speaking to the local press, he said "India is a huge market for gemstones. Indian traders are very much interested in buying coloured and rough stones from Pakistan after the recent improvement in relations between the two countries. Indeed, in the aftermath of the disastrous earthquake that struck Pakistani occupied Kashmir and AJ&K, there has been a drastic toning down in the sometimes frosty-j sometimes fiery rhetoric and India has proved herself to be a compassionate neighbour in Pakistan's hour of need by being the first to commit tons of relief supplies worth millions of dollars, |

||||||

|

||||||

|

Now if the two countries choose) to build on this growing warmth between them, the Pakistani gemstonej sector stands to gain substantially b reaching out to India for its expertisi in cutting and polishing gems. India' multi billion dollar turnover of gems andjewellery is all on the manufacturing side as India's own gemstone reserves do not account for a significant part of these numbers as yet and if Pakistan can learn to add value to its gemstone resources locally then it can effectively multiply its earnings from the sector, which currently stand at only around 28 million Pakistani rupees. A recent report in the Pakistani press suggests that if developed to its full potential, the mining industry (gemstones and industrial minerals included) could be worth more than 3 billion dollars per year. Apart from India, there are other countries that Pakistan can turn to for guidance. China for one is being touted as the next great gemstone centre of the world. Thailand, which is indisputably one of the fine manufacturing centres for gems and jewellery, should also be approached. Joint ventures can be undertaken. If Thai companies are unwilling to invest in Pakistan, maybe the Pakistani government could consider investing in sending their people to Thailand for training in lapidary and jewellery manufacturing skills. |

||||||

|

||||||

A lot of investment in terms of hardware will also have to be done and all this will require finance and help from the government sector. Some of the contributing factors to the low quality of gemstone cutting and polishing are the antiquated tools that are used and the lack of expertise in precision and calibrated cutting. Also, it is estimated that there are only about 30,000 workers involved in the governmentsector. Some of the contributing factors to the low quality of gemstone cutting and polishing are the antiquated tools that are used and the lack of expertise in precision and calibrated cutting. Also, it is estimated that there are only about 30,000 workers involved in the gemstone trade, and unlike other centres like India or Thailand, they are not centred in one or two locations but are scattered all over Pakistan. All in all there are only about 500 cutting and polishing units in Peshawar, Lahore and Karachi. The government will have to invest in importing machinery, human resource development via training centres and setting up gemstone cutting and polishing courses in vocational colleges, setting up gem labs, etc. The government will also have to provide assistance in the marketing and promotion of its gemstones in the international markets. Subsidising Pakistani exhibitors at international trade fairs would be a good start. This September, the Bangkok Gems & Jewelry Fair hosted its first ever Country Pavilion from Pakistan and it was a revelation to the Thai and international buyers as they all flocked to see what this South Asian country is capable of producing. Simplifying the export procedure would also help. Basically, the entire infrastructure for the industry would have to be built up from scratch as it were for there isn't a sustainable one in place currently. |

||||||

|

||||||

|

In the past, this long list of requirements might have met with pessimism but with the current government, it might just be possible. President Pervez Musharraf has proved to be a leader who has the political will to move mountains if need be. In the past three to four years, his government has seen solid macroeconomic progress thanks to IMF approved government policies and generous foreign assistance, which has been put to good use and foreign exchange reserves have continued to rise. It is a government that has shown itself as willing to make the changes required for progress and has proved it by taking some bold steps. Therefore, if Pakistan's gemstone industry wishes to take the great leap forward, now is really the best time to do it. |

||||||

| American Press Focuses on Negative Aspects of Gold Mining | ||||||

|

||||||