|

|

The

Pariba Promise

By Pariba Promise |

|

| |

“Heitor the

Fool!” was the general comment that locals used to describe

Heitor Dimas Barbosa, the man obsessed with digging for gems

that he believed would be completely different from anything

anyone had ever seen before. Urged on by an inner guidance,

Barbosa dug and tunneled for seven years in a hill behind the

village of Sao Jose de Batalha, Paraíba, Brazil, a region

that is famously arid, rugged and poor, with one of the lowest

per capita incomes in the nation. It is a land with nearly no

water and scorching dry seasons.

In 1981, when Barbosa first started his quest, electricity was

more than a decade away. In 1987, the first gem was found at

the Batalha Mine in Paraiba. Barbosa had unearthed one of the

rarest gems of the world: a tourmaline uniquely coloured by

copper — cuprian — that creates a mesmerizing vivid

blue and bluegreen hue with an electric glow. |

|

| |

|

|

| |

A) Cuprian elbaite from the Batalha mine, 5-cm

crystal with 1.3-cm (4-carat) cut stone. Michael Scott collection;

Van Pelt photo courtesy of Michael Scott.

B) Cuprian elbaite crystal from the Batalha mine showing blue

and turquoise-blue zones, 3 cm, with 2-carat (9-mm) cut stone.

Michael Scott collection; Van Pelt photo courtesy of Michael

Scott.

C) Intense colour saturation from their copper content is the

trademark of the stones from the original Batalha Mine.

D) The Batalha mine workings on Frade Hill. Brendan Laurs photo.

E) The village of Sao Jose da Batalha; the Batalha mine is visible

in the distance. Brendan Laurs photo.

|

|

| |

These startling

gems emerged onto the world stage in 1990 in Tucson, Arizona,

at various venues during the February gem shows. Due to their

unreal neon appearance, the gems were initially met with skepticism.

Nonetheless, these tourmalines from the Paraiba mine that were

selling for $250 a carat at the start of the shows skyrocketed

and six days later, at the end of the shows, were selling for

as much as $2,500 a carat.

Skepticism had been replaced by awe.

“Ultramarine,”

“neon” and “electric” were words passionately

exchanged to describe these exceptional tourmalines. A basic

question that came up time and again was “Where is this

stone from?” The answer, “Paraiba,” became

so associated with the stone it became known as “Paraiba

tourmaline.” The buzz was phenomenal.

And

while production of original Paraiba tourmaline has dwindled,

today, work continues in a new section of the Batalha Mine.

Some 90 percent of the tourmaline production at the site occurred

between 1989 and 1992. Starting around 1998, small tourmaline

stones and the occasional 0.50-carat to 2-carat tourmaline were

found sporadically as miners worked the soil and alluvium material

surrounding the mine. The very mention of this stone brings

hope for a new discovery of similarly saturated tourmaline at

other mining sites or even, possibly, in the new section of

the original mine now being explored. |

|

| |

|

|

| |

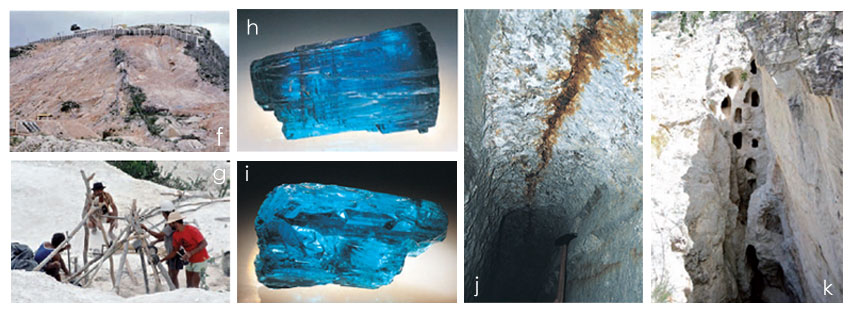

f) By the late 1990s, scraped to the bedrock,

the original Batalha Mine hill was producing only tiny fragments

and occasional stones in the soil and nearby alluvium, while

an eager

market waited impatiently for any gems or news of new discoveries

from this source.

g) From 1982 through 1995, almost 10,000 feet of shafts, drifts

and tunneling were accomplished by hand with candlelight and

rudimentary tools. This photo from 1990 shows miners working

a hand winch to haul material from approximately 130 feet below

ground, where, at that time, the strongest concentrations of

the “neon” stones were found. The mountains of white

clay — kaolinite, host to the elusive tourmaline —

attest to the volume of extraction being done.

h) Cuprian elbaite, 3.3 cm, from the Batalha mine (ca. 1989).

Brian Cook specimen; Wendell Wilson photo

i) Cuprian elbaite, 2.2 cm, from the Batalha mine (ca. 1989).

Brian Cook specimen; Wendell Wilson photo.

j) Cross-section of one of the pegmatite veins visible in the

roof of a drift at the Batalha mine. Brendan Laurs photo.

k) Cross section of the Batalha Mine’s original Heitorita

vein, which produced the most intensely coloured stones. Additionally,

many combinations of hues were found at different

levels of this vein, including polychromezoned tourmalines in

various colour combinations. |

|

| |

The Batalha Mine’s

tourmaline commands the highest per-carat prices simply because

it is superior in colour saturation to any other source of “Paraiba-type”

cuprian tourmaline in the world. Prices today for top-quality

stones larger than 10 carats can reach beyond $100,000 per carat.

A ceiling price has never been established because prices for

these tourmalines continue to climb.

Brian

Cook, a geologist and co-owner of Nature’s Geometry, a

gemstone trading and design company in Tucson, Arizona, and

Bahia, Brazil, wrote this story based on his face-to-face conversations

with Barbosa and his numerous visits to the Batalha Mine since

the 1980s. |

|

| |

|

|

| |

l) Cuprian elbaite, 1.7 cm, from the Batalha mine

(ca. 1989). Wendell Wilson collection and photo.

m) Drifts and shafts in one of the four original veins, where

the near-vertical vein drops down almost 150 feet from the surface.

Access to the mine was by rappelling handover-

hand up or down a rope held in place by sticks lashed together.

This was the only way in or out of the mine until 1995, when

an access tunnel was created.

n) This view is of the southern extension of the Heitorita vein,

which is being explored today at a deeper level. The water table

impedes progress as it causes the 6-feet- to 15-feetwide kaolinite

vein to collapse. However, there have been some new finds of

the original-colour tourmalines in small sizes in the 2-millimetre-or-less

range. Investment in

modern mining equipment will be necessary to go deeper into

the mine.

o) Old workings at the Batalha mine from which much cuprian

elbaite was taken. Brendan Laurs photo. |

|

| |

|

|

| |

|

|

| |

Will

Holidays Save Diamonds?

By Avi Krawitz

|

|

| |

The diamond trade,

much like the global economy, has been buoyed by mature markets

in 2013 while emerging economies have been jitter. That trend

continued in September as the industry started to gear up for

the fourth-quarter holiday season. With Diwali, Christmas and

the Chinese new year on the horizon, expectations rose for a

spurt of activity driven by a study U.S. market and a hoped-for

rise in Chinese demand.

The

focus of the trade turned to the Fair East in September in the

hope that the Hong Kong Jewellery & Gem Fair would confirm

a reawakeninf of Chineses Demand ahead of the October Golden

Week - considered the second-busiest retail festivalin China

after the Chinese New Year. Trading at the show was mediocre

with selective demand and a strong emphasis on lower price points.

But it was indeed the Chinese buyers who dominated activity

, even as overall trading was at lower levels than in previous

years. |

|

| |

|

|

| |

Conservative buying

at the show was not enough to drive the rise in polished prices

that supplies had hoped for. The RapNet Diamond Index (RAPI)

for 1-carat certified polished diamonds fell 0.4 percent during

the period September 1 to September 17. RAPI for 0.30-carat

diamonds increased 0.6 percent, while 0.50-carat diamonds dropped

0.2 percent. RAPI for 3-carat diamonds was up 0.1 percent during

the period.

Throughout the

month, there remained strong demand for 0.30-carat to 0.60-carat,

G-H, VS-SI, triple EX Goods, while demand for J-M, VVS goods

in the same sizes was steady. Similarly, there has been stable

demand for 1-carat, J-M, VS-SI Goods. Fancy shapes and fancy

colour diamonds are selling well as buyers seek creative ways

to work withn their budget constraints.

Chinese

Caution

There was

a sense that chinese buyers needed to buy in September to prepared

for the holiday season because retail jewellers were holding

relatively low inventory, reflecting their own caution about

the local market.

Analysis

note that china is at a crossroads in its transition toward

becoming a consumer -driven economy. The government has tried

to implement some structural reforms, such as liberalizing interest

rates, working toward making the yuan a fully tradable currency

and taking steps to reduce its dependency on exports. Encouragingly,

while the economy is expected to slow toward annual growth of

7.5 percent in 2013, China’s exports grew in August, signaling

that the economy is slowly recovering from its previous slump.

Despite the slowdown, there remained a steady flow of diamonds

throughout the region. Hong Kong’s polished imports rose

5 percent year on year to $8.88 billion in the first half of

2013, while polished exports from Hong Kong fell 4 percent to

$5.8 billion. Net polished imports — which is the excess

of imports over exports, indicating the amount of goods that

remained in Hong Kong — rose 28 percent to $3.08 billion.

|

|

| |

|

|

| |

|

|

| |

Mixed Markets

Financial

markets in the region have also reflected caution about the

economy, with Hong Kong’s Hang Seng Index having a down-and-up

year to remain about flat since January. A similar pattern has

been witnessed in other emerging markets, with India’s

Sensex Index also flat for the year so far. In contrast, stock

markets in the mature economies of the U.S. and Japan rallied

in 2013, with the Dow Jones Industrial Average and S&P 500

indices up about 15 percent each, while the Nikkei 225 has soared

34 percent this year.

It

is little wonder, then, that confidence in the diamond trade

in these centres has improved this year, particularly in the

U.S., where jewellers have grown increasingly upbeat about the

year-end season. Diamond dealers in the trading centres are

pinning their hopes on that trend continuing for the rest of

the year. They note that slower trading in September was influenced

by sporadic activity in Israel, New York and Belgium, where

many businesses closed during the various Jewish holidays that

took place during the month. In India, the volatile rupee, which

recovered somewhat from its previous lows of

approximately 70 to the dollar, continues to weigh on demand.

Currencies Impact Rough

The

sharp fall in various currencies has impacted trading in a number

of centres. While the Japanese yen has depreciated by about

25 percent against the U.S. dollar in the past year, polished

diamond imports to Japan have increased by 12 percent year on

year when measured in yen, but declined 7 percent in dollar

terms in the first seven months of 2013. Perhaps most significantly,

foreign exchange fluctuations have affected trading in the rough

market as manufacturers, dealers and miners have had to hedge

currency movements. |

|

| |

|

|

| |

Alrosa reported

that its net profit fell 10 percent to $453 million in the first

half of 2013, partly due to foreign exchange losses. The Russian

ruble has dropped 7 percent in value against the U.S. dollar

since the beginning of the year. Alrosa’s sales increased

7 percent to $2.55 billion in the six months even as the average

price of its gem-quality rough diamonds fell 11 percent from

the previous year. The company noted that prices rose 3 percent

in the first half of the year. However, it is the slump in the

rupee that has most impacted sentiment in the rough market,

particularly as the rupee hit an alltime low in the middle of

the most recent De Beers sight in late August. The weak rupee,

coupled with high rough prices and lower bank credit to buy

rough, has resulted in tight liquidity among Indian manufacturers.

The depressed sentiment has spread to dealers and manufacturers

in the diamond sector in other countries.

As a result, many sightholders

refused De Beers goods, with an estimated 20 percent to 25 percent

of goods left on the table, after average rough prices maintained

relatively high levels at the sight. De Beers reduced prices

slightly on most boxes at the sight and increased prices on

more popular boxes. The

sight had an estimated value of $600 million before refusals.

As a result, there was very little trading of De Beers goods

on the secondary market in September due to a shortage of available

rough and due to the lack of profitability in the boxes. Dealers

were forced to give long-term credit in order to achieve their

desired prices.

Manufacturers voiced their discontent

with the situation and are hoping De Beers will make more significant

price reductions in October. They’re equally hoping that

the expected seasonal spike in demand will help raise polished

prices and improve their profit margins. With Diwali, Christmas

and the Chinese New Year coming up, they may have better times

to look forward to, after the cautious sentiment in the market

throughout 2013 lingered in September. |

|

| |

|

|

| |

|

|

| |

The

Timeless Allure of Art Deco |

|

| |

The

Roaring Twenties — It’s a time that still fascinates

us.

Autos, the radio, the telephone,

and the motion picture became cultural fixtures. Skyscrapers

sprung up in major cities. Jazz rang from speakeasies in

Harlem. F. Scott Fitzgerald, Ernest Hemingway, Coco Chanel,

Duke Ellington, Babe Ruth, and Charlie Chaplin commanded the

cultural stage, their

fame fueled by the rise of the mass media.

The role of women was also changing.

Entering the workforce en masse during World War I, women

gained the right to vote in 1920. Flappers

— women who wore short dresses and short hair —

were the new standard bearers of fashion, shocking society

with their scandalous behaviour. And they

wanted a new style, something that was not like the frilly,

traditional jewellery of the Edwardian and Art Nouveau eras.

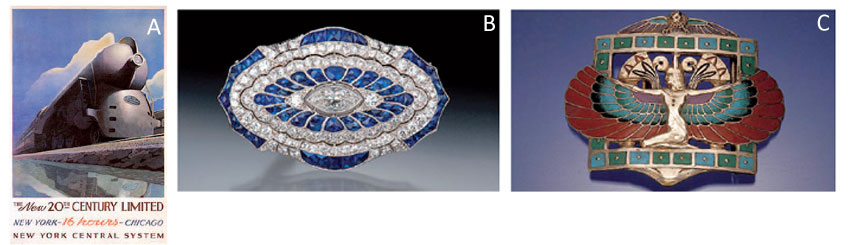

Such was the setting for the

arrival of Art Deco — a style that celebrated the machine

age. Sleek ocean liners, streamlined trains, and towering

skyscrapers were favourite images to express this: they symbolized

prosperity, and progress, and the belief that technology was

the cure for all ills.

The term “Art Deco”

— the period lasted from the 1920s through the 1930s

— came from Exposition Internationale des Arts Decoratifs

et Industrials

Modernes, an exhibition of decorative arts held in Paris in

1925. Jewellery was one of the featured items, and the judges

selected geometric, linear pieces that celebrated modern industry.

To give objects a futuristic

look, Art Deco artists used vertical lines and geometric shapes

(arcs, circles, triangles, squares, rectangles, etc.) in

repetitive patterns. The Chrysler Building in Manhattan is

a classic example of Art Deco architecture, and features a

number of these design elements.

Jewellery designers were very

much a part of the Art Deco movement. Departing from the organic

curvilinear flourishes that belonged to the earlier

movement, Art Nouveau, these designers embraced the vertical

line and simple, repetitive geometric patterns. The purpose

was to evoke elegance and

sophistication.

Art Deco jewellers used platinum

and white gold, geometric shapes, and vivid colour, contrasts

to capture the spirit of the time. Diamond cuts in

geometric shapes such as the baguette, triangle, trapeze,

and half-moon became popular in Art Deco jewellery.

Advances in stone cutting allowed

jewellers to make complex pieces, like this platinum, sapphire,

and diamond pendant/brooch shown in the accompanying picture.

A significant event in the Art

Deco movement was discovery of King Tut’s tomb in 1922.

Egypt’s art and architecture were exotic — fresh

inspiration

to artists schooled in old-world masters like Michelangelo

and Rembrandt — and Art Deco practitioners readily borrowed

motifs from it and other ancient civilizations that were being

unearthed. |

|

| |

|

|

| |

A) This Art Deco poster of a train conveys the

power of technology and progress

B) Brooch courtesy of Frank Goodman & Son, Los Angeles,

CA.

C) Buckle courtesy of Ginger Moro. |

|

| |

Art Deco artists were

simultaneously taking from the past and looking to the future.

This was a unique combination, and created a distinctive style

that gripped the imagination of the public.

The

timeless beauty of Art Deco and its promise of a bright future

is what captivated the flappers — and it still speaks

to us. F. Scott Fitzgerald poetically expressed this sentiment

in The Great Gatsby: “Gatsby believed in the green light,

the orgastic future that year by year recedes before us. It

eluded us then, but that’s no matter — tomorrow

we will run faster, stretch out our arms farther. . . So we

beat on, boats against the

current, borne back ceaselessly into the past.”

Tips for Art Deco jewellery ?

-

Art Deco was defined by the vertical line and repetitive geometric

shapes. Use them to design Deco-inspired pieces. Let your customers

know how these design elements create a sleek and sophisticated

look. ?

- Art Deco jewellery

often has dramatic colour contrasts. Perhaps this was an expression

of optimism towards the future, or a welcome change

from the pastels of the Art Nouveau era and the typical absence

of coloured stones in most Edwardian-Era jewellery. Use of bold,

contrasting coloured gemstones or enamel in your pieces can

evoke the Art Deco style.

-

Art Deco artists freely borrowed design elements from ancient

cultures. The contrast of the modern and the old made for fascinating

works. Customers are likely to find this interesting. You can

also incorporate ancient motifs to add pizzazz to your designs. |

|

| |

|

|

| |

D) The Chrysler Building is an Art Deco masterpiece.

E ) Art Deco chandelier earrings made with platinum, emeralds,

sapphires, and diamonds.

F ) Tutti Frutti (bold colour contrasts using carved gemstones)

dazzles in this bracelet, brooch, and lapel watch by Mauboussin.

Jewellery courtesy of Kathryn Bonanno. |

|

| |

|

|

|

|