| |

| Lucara

Reports Big Diamonds |

Lucara

Diamond Corp. has recovered 13 diamonds larger than

100 carats, 2 of which exceed 200 carats, since the

start of the second quarter. Of the 13 stones recovered,

8 are gem quality diamonds. The 5 largest gem quality

stones weigh 259 carats, 239 carats weighing 153 carats

each and a 133 carats stone. Since the begining of

the second quarter,the Karowe mine has 239 produced

239 diamonds larger than 10.8 carats, including 27

diamonds with weights between 50 and 100 carats.

Lucara also announced

that its second Exceptional stone Tender will take

place on July 18. Client viewing will take place on

July 18. Client viewings will take place in place

in both Antwerp and Gaborone. The compony is in the

process of selecting stones for the tender and will

post information about it along with a brochure on

its website.

Willam Lamb, President

and CEO, commented, “The ongoing recovery of

these large and exceptional white diamonds continues

to drive increased value for Lucara and its shareholders

and has established the Karowe mine as a rare source

of diamonds. The ongoing recovery stones is encouraging

for a potential third exceptionnal stone tender during

the fourth quarter of 2014" |

|

|

Lucara

has two key assets: The Karowe mine in Botswana and

the Mothae project in Lesotho. The 100-percent owned

Karowe mine is a newly constructed state-of-the-art

mine which was fully commissioned in 2012. At the

75-percent owned Mathae project, The compony has completed

the trial mining stage and is working towards completing

a preiiminory economic assessment. |

| |

|

|

| CIBJO

Mulls Synthetic Diamonds |

The topic of synthetic diamonds dominated the

CIBJP congress in Moscow. The Three-day congress

brough together over 130 delegates from 22 countries

to explore numerous commission reports and research

along with other issues impacting the industry.

Most delegates

agreed that the role synthetic diamonds play

in the market is one of the most important issues

across the industry today. The issue of synthetic

diamonds cropped up a lot over the last year

and we felt the need to explain what it is so

that there would be no fear, "said Udi

Sheintal, the president of ClBJO's diamond commission.

The synthetic diamonds are here and they will

have their place on the shelf.

St. Petersburg-based

lnreal explained how chemical vapour deposition

(C\/D) and high-pressure high-temperature (HTHP)

techniques enable diamonds to grow on multi-seed

pIates. Dr . Andrey Kartusha, who implemented

the technology for the company, said that the

existing demand for diamonds will allow synthetics

to fulfill as much as 3 percent of the market's

requirements. So far, however, the majority

of synthetic diamonds are used for technical

applications, yet the company confirmed it polishes

and sells a small portion of production to the

gems market, at prices around minus 50 Rapaport

to test business demand. |

|

|

|

Panelists said that

there was no problem selling Synthetic diamonds on

the market, the issue is disclosure, since some companies

conceal the fact that the gems they sell are synthetic.

Detection technology is able to identify synthetic

diamonds and these machines were presented by panelists,

including those manufactured by De Beers and the Gemological

Institute of America (GIA)

"Between GIA and

De Beers we have enough equipment to check the diamonds,

the problem is that they are too slow," said

Ronnie VanderLinden, the president of the Diamond

Manufacturers & importers Association of America

(DMIA).

Susan Flamm, the senior

counsel for the Jewelers Vigilance Committee (JVC),said

regulations imply that sellers are responsible for

the diamonds they sell, even in the case where the

law was unknowingly broken and the diamonds turned

out to be synthetic . However, she said that there

have been no complaints so far to JVC regarding undisclosed

sale of synthetic diamonds.

Synthetic diamonds represent

only one of many issues facing the industry that all

need "to keep the house in order" and be

tranparent, according to Gaetano Cavallieri, the president

of ClBJO.

|

|

| 'The

Blue' Breaks Record |

A

pear-shaped blue 13.22 ct diamond nicknamed

'The Blue" has broken the world record

at auction, having been sold to American jeweller

Harry Winster for $23.8 million.

Thought to have

been mined in South Africa, the blue diamond

was described by auction house Christie's as

"absolutely perfect" ahead of the

sale last month. The vivid stone also set a

world auction record of $2 million per carat

for a blue diamond.

In the past decade,

only three blue diamonds of 10 carats or more

with the same vivid grading have been sold at

auction. All weighed less than 12 carats and

none were flawless. |

|

|

|

|

| |

| Thai

manufacturers heading for Ruby rough auction in Singapore

|

Thai gem and jewellery industry leaders have been

holding a series of talks with major international

producers and traders of gemstone rough.The objective

is to establish in Thailand a specialized facility

for the auctioning of gemstone rough, brought in from

around the world.

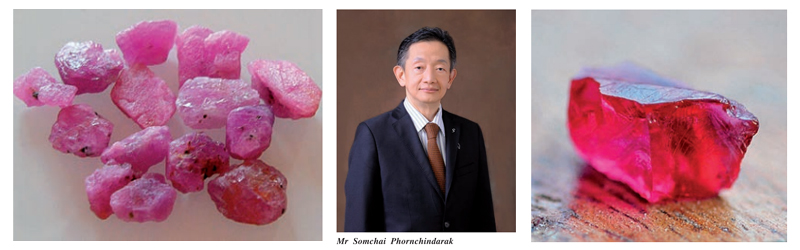

Mr Somchai Phornchaindarak, Preseident

of the Gems Jewelry and Precious Metal Confederation

of Thailand and the Thai Gem and Jewelry Traders Association,

told Bangkok Gems & Jewelry Magazine that the

talks are progressing favourably, and that plans for

the auction faculty are being drawn up. "Thailand

is a world hub for trading and cutting coloured gemstones.

It is only logical that Thailand should host a permanent

dedicated facility for auctioning rough gems. The

buyers are here. Sellers will be getting the best

prices here, because the demand is here, "Mr

Somchai says.

As presently envisaged, the auction facility

would incorporate high security, the relevant commercial

services, and a specialized trading hall with full

natural lighting - daylight - which is essential for

accurately viewing and evaluating gemstones. While

a site for the facility is stil to be decided upon

, the Gemopolis Gem and Jewelry Industrial Estate

is under consideration as a possible location. Conveniently

situated near to Bangkok's Suvarnbhumi International

Airport, Gemopolis already has all the infrastructure

and services needed for a specialized gemstone rough

trading operation. |

|

Meanwhile, some 32 leading Thai Gems traders and lapidaries

will be converging on Singapore at the middle of this

month (June) for the inaugural ruby rough auction

being held by the British gem mining company Gemfields

PLC. The ruby rough being auctioned comes from Gemfields'

Montepuez mine in Mozambique.

Gemfields is an established large-scale miner

of emerald and amethyst in Zambia, and is now bringing

into production its ruby mine in Mozambique. Gemfields

sells its output of gemstone rough through private

auction, with sealed bids. Gemfields has been holding

successful gemstone rough auctions in Zambia, Jaipur

and Singapore.

A Dedicated gemstone rough auction facility

in Thailand would attract producers, traders and buyers

from around the world. It would assist in securing

supplies of rough, at good prices, for the Thai Gem

cutting sector. And under the Thai Government's Zero-VAT

initiative, all gemstone rough coming into Thailand

is exempted from the standard 7% Value Added Tax-making

Thailand an internationally competitive venue for

trading of gemstone rough.

The proposed gemstone rough auction facility,

when in operation, will enhance Thailand's image and

competitiveness as the world's gems and jewellery

hub.

|

| |

|

|

Custodians

of Colour

By Avi Krawitz |

|

|

|

Gemfields makes no secret of its ambition to be the

custodian of the coloured gemstones industry. With

its emerald and ruby mining operatlons ot the core

of its business, the company has aggressively built

a marketing platform to drive demand for colour.

“What De Beers did for diamonds,

we'd like to do for other gemstones, starting with

emeralds, rubies, amethysts and, hopefully soon, sapphires,"

lan Harebottle, CEO of Gemfields said. “De Beers

made a mistake in that it focused on one gem,and now

we see there's a definite move back to colour."

Horebottle orgues that before De

Beers iconic mdrketing push, with slogans such as

‘A Diamond is Forever,’ otherso-called

precious stones— particularly emeralds, rubies

and sapphires — were sold on an equal footing

to diamonds. By combining its mining programmes with

strong marketing, Gemfields hopes to restore some

of the balance — particularly given that coloured

stones have garnered such strong interest in the past

few years.

In 2013 alone, Harebottle estlmated

that the company's emerald prices rose 15 to 18 percent,

mirroring the rise in consumer demand. Similarly,

coloured diamonds — which Harebottle stresses

are also gemstones — continues to enjoyed a

boom in demand and prices.

Gemfields believes it can capitalize

on the trend and inspire further growth by following

the De Beers model, wiih the benefit of hindsight

to avoid De Beers model, with the benefit of hindsight

to avoid De Beers mistakes and build on its successes.

|

|

De Beers -like strategy

Harebottle explained the

company's strategy is focused on a number of aspects

that draw from the De Beers experience: acquiring

the right mines, investing in technology to maximize

production volume, creating a rough grading system

in order to offer the downstream market a consisdent

supply of same-quality rough, choosing the right clients

who will partner with Gemfields in branding and marketing

compaigns and maintaining a strong marketing presence

of its own.

Gemfields owns

75 percent of the Kagem emerald mine in Zambia along

with two other emerald mines in Zambia that are currently

on care and maintenance. The company also owns 50

percent of the Kariba amethyst mine in Zambia, a 75

percent stake in the Montepuez ruby mine in Mozambique

and various exploration licenses in Zambia and Madagascar.

Harebottle estimates

that Gemfields has about 20 percent market share of

global emerald supply, and 40 percent for amethyst.

The company is preparing its first ruby auction in

June and expects to gain approxamately 20 percent

of the market within the next two years.

While Harebottle

insists it's not about gaining market share, the grownth

in volume has anabled Gemfields to offer clients consistent

supply by developing a grading system to sort like-for-like-stones.

That way, he explains, high-end clients as well as

companies that polish more commercial-quality goods

can getthe supply they need, rather than everyone

getting a mix of categories, which is what he claims

generally occurs in the gemstone sector.

Gemfields has

also started to auction goods on behalf of other miners

using the same grading method and hopes that the system

will eventually gain industry wide acceptance. |

|

Portfilio

Potential

The company has amassed

a relatively large inventory of emeralds that has

helped to ensure the consistency of supply in the

short term. The value of its inventory grew 83 percent

to $71.2 million at December 31,2013 from a year earlier,

while emerald production at Kagem fell 28 percent

year on year to 10.4 million carats in the first fiscal

half year that ended December 31.

Earings for the

six month period were mixed as sales more than doubled

to $65.7 million, while cost of sales more than tripled.

Harebottle argued that costs higher because Gemfields

is a bigger business than before. Net profit fell

70 percent to $1.4 million during the six month period

due to the higher costs.

Still, Investors

are encouraged by recent developments and Gemfields

shares have increased by about 20 percent on London's

Alternative investment Market(AIM) since the beginning

of the year. Analysis at Finncap in April maintained

a 'Buy' recommendation for the share, starting that

they expect the company to return to profit after

a difficult period where its ability to freely sell

its emeralds was questioned.

|

|

That doubt came when the Zambian government

requested Gemfields to hold its auctions in Lusaka instead

of abroad. Harebottle said the company has a good relationship

with the government and will continue to auction its

goods in Lusaka-until it might be able to do some there

and a portion closer to sonsumer markets, as it did

before.

Finncap

noted that the upcoming inaugural ruby auction presented

further upside potential for Gemfields, as did the portfolio

of exploration projects in Madagascar that are considered

to be prospective for emeralds, rubies, sapphires, tourmalines

and garnet.

Harebottle

is eyeing other assets to compliment Gemfields' position

in the emrald, amethyst and ruby market, in particular,

he wants to bring sapphires into the portfolio and reports

that the company has been in talks with the Colombian

government with the intent of buying an emerald mine

there. "These things take time and we're not chasing

anything, but if the right asset comes along, we are

looking for acquistions, "he said. |

|

Generic

Marketing Mix

However, Gemfields most

significant acquisition was arguably made outside the

mining sector when it acquired the Faberge brand in

January 2013.

The

company explained that it bought Faberge "With

a view to create a globally recognized colour gemstone

champion." Harebottle added that the iconic jewellery

brand was perfect because it focued on the high-end

with just a few stores, but had the name recognition

that enabled it to influence trends.

"Faberge's jewellery has an abundance of colour

so it was the perfect way that we felt we could associate

with a phennomenal brand and champion colour, "he

said, Increasingly, Harebottle added, there will be

joint marketing campaigns meshiing the Faberge and Gemfields

names together. |

. That

would bring more of a brand focus to Gemfields'

marketing as its branding has intentionally

been relatively understated until now. Unlike

De Beers, which has shed its role as custodian

for the diamond industry by shifting from generic

to brand-focused marketing, Gemfields recognizes

that it needs a blend of both-given that gemstones

have lagged behind diamonds due to De Beers

marketing efforts.

Harebottle asserts

that the Faberge acquistion, along with the

appointment of A-list actress Mila Kunis as

Gemfields brand ambassador, has lifted the company

from below the radar of both consumers and investors.

He hopes Gemfields is now in a position to drive

consumer demand-albeit with a smaller market

share through which De Beers influenced diamond

demand-by marketing primarily colour and secondaly

its stones and jewellery.

"Our intention

is not to own or control the industry. Our priority

is to grow awareness and encourage consumers

to consider colour," he said "The

industry needs leadership so I undoubtedly see

Gemfields as a a custodian for the gemstone

industry"

. Whether that will be enough

for the gemstones to regain an equal footing

with diamonds, remains to be seen. - Courtesy

of Gemfields. |

|

|

|

|

The

fifth Season

By Roberto Coin |

|

. Robeno

Coin never ceases To surprise, this time he did by creating

an unedited brand which bears his name but also brings

a new message which is as clear as it is poetic.

. With The Fifth Season by Roberto

Coin he takes on a new challenge and reaches a public

that is young in the soul and of timeless elegance.

A public that wants to express itself Through originality,

which is avant garde but still determined to maintain

an ancient fil rouge in elegance. |

|

. The

brand talks about current and future rhyihms, with the

innate class that belongs to great masters, a nonconformist

view to the world of fashion, aware of traditions and

sensitive to society's contlnuous evolution, an excellent

expression of an informal and ethical luxury.

. Roberto Coin's experience and

instinct dialogue with modernity, giving the concept

of elegance surprising nuances and meanings, which are

interpreted in the collections through volumes and lines

that are as extreme as they are refined. |

|

. Enclosing

all the maison's quintessential features of innovation

and quality in its jewels. The fifth Season by Roberto

Coin adapts them to metropolitan dynamism, orginating

an unexpected creativity expressed by the preciousness

of silver declined in different colours.

|

. Each

piece is characterized by the high quality and

precision of Italian artisanal manufacturing,

up to today invested in gold, which guarantee

the selection of precious and natural elements

as a fundamental part and a perfect synihesis

of style’s principles and codes.

. Even in The Fifth Season

by Roberto Coin a small ruby is hidden inside

each jewel, legend to attribules to this wonderful

gem, considered eternal, The power to grant

a long and happy life. This is the wish which

is secrelly passed on to every person who wears

a creation by This brand ... and who chooses

to live and narrdle a season which never exisled

before. |

|

|

|

|

| Labour,

Tax Dominate Diamond Debate |

. The

Diamond Election Debate was held last month in Antwerp’s

Beurs voor Diamanthandel, organized by AWDC, in cooperation

with UNIZO. Current issues and diamond-related topics

such as taxation, competitiveness of the Antwerp diamond

sector and the importance of the financing of the

diamond trade were discussed.

. More than 250 participants

attended this event. It was a vivacious debate with

Meyrem Almaci representing Groen, Philippe De Backer

representing Open VLD, David Geerts representing Sp.a,

Jan J ambon representing N-VA en Steven Vanackere

representing CD&V. |

|

. For more than five centuries

Antwerp has been the world’s most important

diamond trade hub. Now 84% of all rough diamonds and

half of all polished diamonds are traded in Antwerp.

In 2013, total trade was valued at Euro 40 billion.

Due to the uncertain and ambiguous taxation climate,

rapidly decreasing margins and ever growing competition

from other diamond sectors, Antwerp’s leading

position is under serious threat.

. Ari Epstein, AWDC CEO stated,

“In order to remain number one, We need support

from our politicians. Business-friendly taxation and

measures to strengthen entrepreneurship in Flanders

and especially to bolster our SME's in an international

environment are high on the agenda of entrepreneurs

in our country. We are therefore very pleased we organized

this debate in cooperation with UNIZO." |

|

. Almost

all parties called for a reduction in labour costs

and administrative simplification as a means to boost

the competitiveness of our businesses and to create

a stable business climate.

. Of note was the consensus

among Open VLD, CD & V, N-VA and surprisingly

enough Sp.a, to consider and investigate the introduction

of a sales tax for the diamond industry, provided

that such a measure does not constitute a reduction

in the tax level. N-VA Member of Parliament Jan Jambon

and CD&V representative Vanackere called for a

calm debate and not to succumb to damaging rhetoric

for the sake of political advantage. Groen politician

Meyrem Almaci stated she was not in favour of tax

measures, but for a reduction in labour costs combined

with the development of new initiative that could

improve the image of the sector, such as a Fair Trade

Diamond label.

. The Antwerp Diamond Debate

was organized by the Antwerp World Diamond Centre

(AWDC), representative of over 1650 registered diamond

companies and UNIZO, the Union of Independent Entrepreneurs

that represents 85.000 entrepreneurs, self-employed

persons, SMEs and free professionals in Flanders and

in Brussels. |

|

Fancy

Diamond Colour Grading

By Judith Rosby |

| |

The exhilarating

element of colour is Nature’s

inherent way of injecting personality

and excitement in an otherwise

monotonous life routine. The most

and appealing materials in life

are those that exhibit colour

— bright orange and red

leaves in Autumn, crystal blue

oceans in the Caribbean, vivid

and pink sweeping sunsets, and

swirling stars on the midnight

blue sky, among others. Fancy

coloured diamonds are a phenomenon

of nature where the diamond exhibits

a natural colour as its most prominent

feature. While all diamonds elicit

a similar sense of heart fluttering

magnificence, the emotions that

are elicited when you gaze at

fancy coloured diamond are unmatched

in any other aesthetic experience.

|

|

|

|

In colourless diamonds, the absence

of colour is what makes the diamonds

so precious and valuable. However, in

fancy coloured diamonds it is the very

presence of colour and its intensity

that increase their and value.

. While it is

indeed naturally possible to find coloured

diamonds in a single colour, it is significantly

more common to find them with a secondary,

and even a third or fourth colour present

in the colour of the stone composition

of the stone. Many times, these added

elements bring about a special and complex

impression and result in an added facet

of beauty. However, the most valuable

stones are those that exhibit only a

single colour, as this phenomenon is

rarer in the world of fancy coloured

diamonds. |

|

Diamond

Grading

The

colourless diamond grading scale

measures the absence of colour

that is present in the stone,

on a scale of D—Z, and is

divided into six categories. With

the presence of colour comes the

appearance of yellow or brown

in the stone. Actually, the end

of the colourless diamond scale

is where the colour scale for

coloured diamonds begins! The

final two categories in the scale

are referred to as Cape Diamonds,

which are also known as Faint

Yellow or light yellow or Faint

Champagne diamonds.

Although

The categories seem to overlap,

in actuality coloured diamonds

are graded on an entirely different

scale. Not only are they indicated

by the actual colours that are

present in the stone, They are

also assessed by the vibrancy

of their colour.

Diamond Colours

There

are twelve different colours in

which fancy coloured diamonds

appear. They will either display

purely one colour, or will be

combined with overtones of one,

two or even three additional colours.

The secondary tones occur logically

based on the colour wheel of nature,

meaning that a red diamond can

have overtones of purple or brown,

but will not exhibit any green,

for example.

Diamond

professionals use systematic methods

to identify the exact colours

that are present in the stones.

The three attributes that are

used when assessing a diamond's

colour are the hue, the tone,

and the saturation. Together,

these characteristics are all

measured and quontified in order

to identify the stones as a specific

grade on the colour scale.

The hue is the

tint of colour that is present

in the stone.

The Tone is

the lightness or darkness of the

colour.

The saturation

is the strength or purity of the

colours. |

|

|

|

Diamond

intensity

The intensity of the

colour is the strength of the colour

that is shown in the diamond. The intensity

level can be anywhere from a very soft

presence to a very strong presence,

and the stronger the shade, The higher

the value of the diamond. The GIA developed

on intensity scale to uniformly define

The intensity level of the diamond.

The nine grades in

the scale are: Faint, Very Light, Light,

Fancy Light, Fancy, Fancy lntense and

Fancy Vivid/ Fancy Deep/ or Fancy Dark.

For example, the following

depiction represents the full scale

of colour intensity in Pink, Blue, and

Green colour Diamonds. The intensity

scale clearly begins with very soft

colours and progressively demonstrates

a richer colour stone. However, iT is

imporTdnT To undersTdnd Thoir |

|

However,

it is important to understand that not

every diamond colour appears in all of

the above intensity levels. For example,

Orange diamonds cannot be found in Faint,

Very Light, or Light intensities. Only

Fancy Light, Fancy, Fancy lntense, Fancy

Vivid, and Fancy Deep Orange colours can

be found. Black diamonds and white diamonds

appear in only one colour intensity —

Fancy Black and Fancy White. |

Diamond

Cut

The exact

colour intensity of a diamond cannot

be determined from the rough stone.

However,as it would intuitively be understood

, The greater The colour intensity of

the rough, the greter the colour intensity

of the rough, the greater the intensity

of the polished diamond will be. However,

the intensity of the colour is also

significantly affected by the cut and

shape of the diamond. Also, The cut

of fancy coloured (Modified cut) differs

from that of colourless (brillianf cut).

The origin of

the diamond also affects the colour

intensity. Different diamond mines produce

different shades or tones, oherwise

known as ‘material' of due to

the presence of the colour-causing where

the diamond was materialized. For The

majority of the time a Pink diamond

in India or South Africa does not compare

to a diamond found from the Argyle diamond

mine in Obviously, There are always

diamonds in the rough. |

|

History

of Colour Grading

The Fancy coloured

diamond grading scale was developed

by the GIA in the mid—1970s. With

the grownth in populariiy of fancy colours.

The |ndustry grownth in popularity of

fancy colours. the industry required

some sort of a standardization in order

to better define the stones and universalize

the fancy coloured diamond trade. Unlike

The colourless diamond scale, the decision

was made to grade natural fancy diamonds

with a description as opposed to a letter

because of the multitude colour combinations

available.

Colourless diamonds

remain graded on an alphabetic scale.

Many years ago, people used various

grading systems including Roman and

Western numeric to grade their diamonds.

OThers used an ‘A, B, and C’

scale where ‘AA’ and ‘AAA’

would have been given to higher grade

stones, similar to other precious assets

like bonds. ln 1953, a man from the

Gemological lnstitute of America named

Richard T Liddicoat developed a standardized

grading scale that measured colourless

stones from ‘D-Z.’ The letter

‘D’ was chosen as an appropriate

start for the scale not To confuse it

was with the first letter in the word

‘diamond' it seemed to first letter

in the word 'diamond'. It seemed to

fit its position. |

The greatest thing about natural diamond

colour is that it never fades or dissipates.

A diamond can be stored or displayed

for years, and other than simply wiping

the diamond clean it will sparkle as

much as did the day it was first polished.

Thus, coloured diamonds Truly are a

gift? forever. — Courtesy

of Leibish & Co, www.fancydiamonds.net |

|

|

|

|

|

|

|