|

|

Richline

in 11th Annual May is Gold Month |

|

| |

Richline

Group Inc. announces the eleventh annual May is Gold Month

TM event., This annual online and in-store intiative

brings many of the finest jewellery retailers in the world

together to celebrate the love of gold karat gold. For 2014,

May is Gold Month has been reimagined to share the largest

gold trends, while also introducing all new contests and sweepstakes.

This includes ways for fashion-savvy shoppers to share their

love of gold on both and Pinterest and instagram.

"In May we look to celebrate

our love for mothers, graduations, weddings and mark these

moments and relationships with something that will last forever,

said Lindsey Woodruff, Richline’s vice president of

marketing “This year, as gold makes a triumphant comeback

in fashion, we explore our personal experiences with gold,

how we give, why we remember and what we love about this extraordinary

precious metal.” |

|

| |

|

The May

is Gold Month websife, brings together 14 of the largest

jewellery retailers in The U.S., including Amazon.corn,

BJ’s, Fred Meyer Jewelers, Helzberg Diamonds,

HSN, JCPenney, Kay Jewelers, Kmart, Kohl's, Macy’s,

QVC, Sam's Club, Walmart. In addition To The unveiling

of many partners will be also be own May is Gold Month

events and media promotions online, in Their own stores

and, In the case of QVC and HSN, with televised events.

Links to the gold landing pages for partners can be

found at MayisGoldMonth.com

For the first time ever, Richline

is is adding weekly emall reports as part of this annual

in initiative. Subscibers will receive gold trend inferviews

from up industry experts as well as weekly reports that

share the latest looks from many of the world's finest

retailers. Subscribers to this list will also be eligible

to win a $1,000 jewellery shopping spree from The participating

retail partner of their choice.

Mark Hanna, Richline’s

chief marketing officer, said, May is Gold Month has

become an event that both our retail partners and gold

shoppers alike look forward to, it's a great opportunity

to show off the latesr trends and is a celebration of

the current resurgence of gold that the jewellery industry

has experienced over the past few years."

|

|

|

| |

|

|

|

Bonhams

to auction Rare Minerals |

|

|

A number of mineral specimens from

estate sources will be up for sale at Bonhams “Gems, Minerals,

Lapidary Works of Art and Natural History” auction scheduled

to take place on May 20 in Los Angeles.

The

Top lot of the sale is a collection of 27 rhodochrosites,

commonly known as “red gold,” ranging in hue from

a light rosy colour to the rare cherry-red shade. The group

is expected to fetch between $200,000 and $250,000. The rhodochrosites

were mined from the Kaldhari Mangdnese Field in South Africa,

representing a collection gathered over many years from a

region that is no longer producing. |

|

| |

|

|

| |

The Bonhams sale also

will offer a large group of varied mineral specimens

from the estate of Carey A. Parshall of Stamford, Conn.,

obtained mostly on buying Trips from the 1950s through

The 1980s to Morocco, Mexico, Japan, Brazil, and lndia.

The collection features vanadinite, smithsonite, azurite,

stibnite and zeolite.

It will also include a

228,000- carat ruby crystal in zoisite — making

it the largest ruby crystal to be offered at public

auction - expected to fetch, between $100,000 and $150,000.

Other highlights of the

sale includes an exceptionally rare and large demantoid

garnet, expected to go for between $130,000 and $180,000,

and a life-size obsidian carving of a bald eagle, expected

to garner from $80,000 to $100,000.

Additionally, The auction

will offer a multi- gemstone gold and drusy onyx necklace

known as “The American |ngenuity Necklace,”

designed and fabricated by Jeffrey E. Abpling with an

exbected sale price in the range of $60,000 To $80,000.

ln addition to the fine

minerals, the 431-lot Bonhams auction also includes

mammal, dinosaur and plant fossils; loose and rare faceted

gemstones labidary carvings by German masters,' Jewelry;

amber; be petrified wood; meteorites; gold nuggets;

and rare, natural pearls. |

|

|

|

|

| |

|

|

|

IGI

Launches Enhanced Website |

|

| |

|

|

| |

The lnternational

Gemoiogical lnstitute (IGT) has reieased an updated version

of its wepsite. The lap said the changes were made to

be more user-friendly and visually appealing for visitors.

The site has rotating homepage

banners highlighting new photography, as well as revamped

pages depicting the |nstitute’s range of report

options.

It also provides

a comprehensive overview or lGi's gemmological education,

including course detaiis and supporting illustrations.

The wepsite's certification rerrieval

process has been improved as well to aliow users worldwide

To simply enter their report numbers in the search field

to verify. |

|

|

|

|

| |

|

|

|

Banks

Slash Diamond Credit |

|

| |

|

|

| |

|

|

Two

major banks providing financing to the diamond industry

are reducing credit to ciients due to concerns that

rough diamond prices are rising too fast.

AnTwerp Diamond Bank and ABN Amro

Group NV, two of the biggest lenders to the industry,

have reduced the amount to 70 percent of rough diamond

purchases from 100 percent, demanding that buyers of

the stones front up more of their own cash.

"It relates to concerns that

we have about the industry, " Bruno Nelemans, executive

vice president for stategy and communication at Antwerp

Diamond Bank, said. "The bank was not feeling happy

about the pricing of rough diamonds compared to polished

prices and diamond jewellery."

|

|

|

| |

Rough prices have risen strongly in the first quarter of this

year as producers such as De Beers have identified robust

demand for polished stones. "Speculation hurts us as

much as anyone," said

Rough diamond prices rose in 2012 on the

back of a continuing U.S. economic recovery and demand in

China. “They've pushed up prices to unreasonable levels,"

Nelemans said. “The manufacturing and Trading indusTry

is less profitable Than it used to be and we feel it is affecting

The quality of our lending, The quality of our assets and

the quolity of our balance sheet.

"ABN Amro said it reduced the ratio

of its loans to better spread The risk between the bank and

diamantaires to try to entice new lenders to the industry.

“Clients should have more skin in the game Themselves,"

sald Erik Jens, CEO of The InTernational Diamonds and Jewelry

Group at ABN Amro. “We want to balance the risk and

reward for all stakeholders in The industry.”

ABN Amro say that while they've slighily

reduced the size of their total loan book to The industry,

That wasn't the objective of their new terms. Antwerp Diamond

Bank have reduced the ratio of funding for individual transations

while their total loan book has remained about the same size,

according to reports.

“The stronger companies that have

responded to these changes will survive,” Jens said.

“lf margins are eroding there will be companies that

won’t able to step up to these standards, and some companies

will indeed go bust. Others will leave business.” |

|

| |

|

|

|

Rio

Tinto Rough Tender a Success |

|

| |

Rio

Tinto has reported on the success of its first rough

diamond tender of 2014, describing “strong result

amidst unprecedenled parlicipation and a record number

of successful bidders."

Antwerp-based tender comprised

124 lots of rough diamonds from Rio Tinto's Argyle mine

in Austrolia, The Diavik mine in Canada and ils Zimbabwean

mines at Murowa. The lots included while and fancy coloured

rough diamonds, wilh companies successful in Their bids

for The siones.

Patirick Coppens, general manager

for the sale of Rio Tinto diamond products, said: “We

were delighted wilh The bidding, lhe global nature of

the successful bidders and the final result. It speaks

to the strong demand for our diverse diamond portfiolio."

Along The lots was on exceplional

70ct white diamond from lhe Diavik mine, said to be

the most valuable diamond in total dollors. The mining

company also reported “unprecedenied bidding"

for its fancy coloured rough diamonds from these mines,

with yellow, champagne, cognac pink purple diamonds

sold to diamond specialists from around the world.

Israeli diamond manufacturer

L & N Diamonds. a signaficant winner at the tender

said: "It was great to see the tender in both Antwerp

and the highway competitive Israel diamond industry.

Whlist we were delighted with our diamonds the ultimate

beneficiary will be the consumer when these diamonds

will be transformed into beautiful jewellery for the

major consumer markets around the world."

Rio Tinto's nest tender, known as an invitation sale.

will feature a varietuy of rough diamonds from the Diavik

mine, it will be held in Antwerp in May.

|

|

|

|

|

| |

|

|

|

UN

Experts Report Smuggling |

|

| |

|

|

| |

Rough

diamond from Ivory oriirirmis from ivory Coast assumed

to illegally flow into the global market, despite the

embargo introduced in 2005. Rough supplier are carried

out under the auspices of senior military officials.

Several European media reports

that the above statement was made by UN experts charged

with checking and veification of effectiveness of the

embargo.

According to experts, diamonds

mined in northern part of ivory Coast are exported to

the neighbouring countries through a dealers network.

Diamond purchases are paid exclusive by cash, and the

money is supposed directed to purchase weapons. UN experts

say that rough diamonds are partially "exported"

directly through the airport in Abidijan, where police

and customs officers are bribed.

'UN experts pubiished their findings at the time when

Ivory Coast was preparing to join the Kimberiey Process

Certiticaition Schemes, what would enable the Atrican

country to resume rough diamonds exports. According

to the data by Europeon Union, annuai diamond production

in ivory Coast ranges from 50000 to 300,000 carats.

|

|

|

|

|

| |

|

|

|

Zimbabwe

to Reduce Diamond Miners |

|

| |

|

|

| |

The Zimbabwe government has formally informed diamond componies

in Marange that only one or two of them wili be left to mine

in the area. state-owned media reports.

There are seven diamond miners currently

operating in Marange: Anjin Investments Mining Company, Gye

Nyame, Jinan, Kusena Mirange Resources and Mbada diamonds.

The Herald newspaper quoted mines minister Walter Chidhakwa

as saying that he had met the diamond miners and intormed

them that the changes were imminent. “V\/e have invited

the mining companies to discuss policy direction and to deal

with the issue of consolidating financial and human resource

issues,” said Chidakwa “We also discussed policy

direction issues and the issue of equipment.

“We are currently waiting for

the Chinese (Anjin) to come because they said their chaiman

has to come from China and we are rneeting in the second week

of May”

The miners were accused of failiing

to properly account for revenue reolised trom their operations.

They also come under fire recentiy tor not honouring their

obligations to the Marange-Zimunya Community Share Ownership

Trust.

The Herald reports that the remaining

one ot two firms would operate as joint ventures with the

government, However, it was not clear which two companies

would remain. |

|

| |

|

|

| |

The Zimbabwe government wholly

owns Marange Resources through the Zimbabwe Mining Development

Corporation and Speculation was high that it would likely

survive the chop.

A parlismentary committee last

year reported that tens of millions of dollars of revenue

due to the government never arrived. The committee said

the government received just $41 million in revenue

in 2012.

Zimbabwe is expected to mine

16.9$ million carats of diamonds this year, according

to Mines Ministry estimates. Last year, the country

produced 8 million carats, generating $685 million in

sales.

NGOs, such as Partnership Africa

Canada, have accused the ruling Zanu PF party of looting

about $2 billion from Marange, party to finance the

country's military. The party denies the claims, saying

the European Union's decision last September to lift

sanctions on diamond exports showed that operations

were above board.

|

|

|

|

|

| |

|

|

| |

|

|

|

Payment

Slow for Diamonds |

|

| |

Zimbabwe has waited one month to recent paymenf for diamonds

sold in Dubai in March reportedly causing problems for diamond

firms operations, and leading to some calls for Zimbabwe to

conduct auctions in Zimbabwe.

Zimbdbwe held its first Tender of

380,626.24 carats of The Dubai Diamond Exchange Centre March

24, with sales of $29.3 million. But The facilitator of The

sale, Global Diamond Tenders, problems Tronsferring The money

To Zimbabwe, According to state~owned newspaper The Herald

with proof of cash Tronsfer only being received April 24.

Mines and Mining Development Minister \/\/alter Chidhokwa

confirmed the delay saying; “They were supposed to have

Transferred them before Easter; maybe due To inefficiency

on the part of the facilitator hence the delay, "the

nespaper reported. |

|

| |

Marange Resources acting chief executive

Mark Mabhudhu said, "It has taken long for the

payment to come through. We do not know the logistical

problems the facilitator had, but he has just sent proof

of transfer on April 24. "Mabhudhu said the facillator

did not explain the reason for the delays.

Sources said diamond mining

firms that sent their consigments to Dubai were now

facing operational challenges with most of them struggling

to settle debts and pay salaries as a result of the

delay, "This delay has had a negative effect on

companies because they were expecting payment should

come after a few days like what happened with the Antwerp

(Belgium) tenders, but this one took a month."

Zimbdbwe held a tender in Antwerp

in December 2013 and one in Februbary this year, earning

$79.8 million from 1,237,734 carats sold. |

|

|

|

|

| |

|

|

| |

|

|

|

Christie's

Geneva Magnificent Jewels |

|

| |

|

|

| |

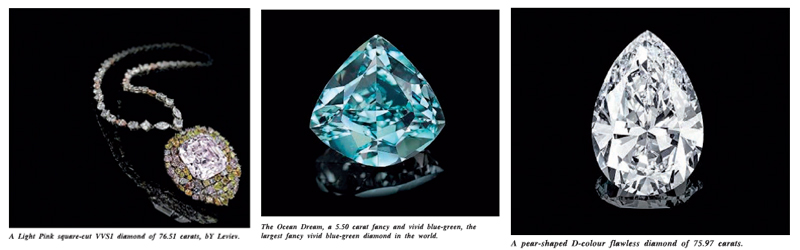

Christie's announces The sale of The Blue,

the largest flawless vivid blue didmond in The world. Weighing

13.22 carats, This sensational stone will lead Christie's

auction of Magnificent Jewels To be held in Geneva on 14 May

2014 at The Four Seasons Hotel des Bergues, Just six months

earlier, ChrisTie’s Geneva sold The Orange, The largest

fancy vivid orange diamond in The world for US$355 million,

a world record for an orange diamond and a world auction record

price per carat for any diamond at US$2.11 million. The Blue

is estimated to fetch US$21,000,000 — 25,000,000 and

is the leading gem of The 250 lot strong sale which is estimated

to fetch a toal in the region of US$80 million.

The sale will feature many important coloured

and colourless diamonds such as the Ocean Dream, at 5.50 carats

The largest fancy vivid blue— green diamond in The world

to come to auction. with an estimate of US$7,500 .00 —9,500

.000. The combination of its size, natural origin, hue, and

saturated colour makes it an extremely unusual occurrence.

The Light Pink square-cut diamond of 76.51 carats set as necklace

centre piece by Leviev, estimate: US$7,000,000-10,000,000,

is another rare coloured diamond in The sale. A pear-shaped

D-coloured Flawless diamond of 75.97 carats, estimated at

US$13,500,000 — 15,500,000 will be in The large offering

of perfect diamonds. |

|

| |

|

|

| |

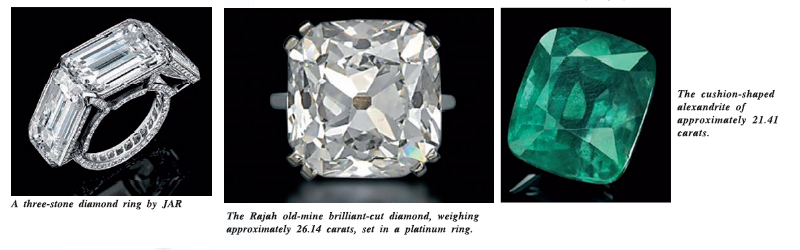

The cushion-shaped alexandrite 21.41 carats

is accompdnied by report of the Swiss Gemmological lnstitute

stating That the alexandrite is of Russian origin with no

indications of treatment and a distinct colour-change from

green to purple and on appendix letter indicating That "a

natural alexandrite from Russia of This size and quality is

and exceptional and thus can be considered very exceptional

Treasure of nature (Estimated US$500,000 — 700,000)

Considered as The greatest contempory jeweller,

Joel Arthur Rosenthal, JAR is synonymous of exceptional craftsmanship.

Passion for perfecttionism are team freely used in a world

that revolves around exaggereated sensation, but these two

words seem to perfectly sum up the extraordinary creativity

and drive of this unique creator, JAR jewels are extremely

and whenever They come up for auction They acctract the interest

of The world's most demanding collectors. The spring sale

in Geneva will offer an elegant three rectangular-cut diamond

ring, estimated at US$330,000 — 460,000 wiih proceeds

to benefit "Ospendale Pediairico Bambino Gesu' in Rome

and the Pediairio department of The Ospedale Sao Paolo’

in Milan. |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

G.L.D.A.

Las Vegas Gem & Jewelry Trade Show |

|

| |

|

|

| |

G.L.D.A

- Gem & Jewelry Show - Las Vegas Z014 is a leading event

in the USA. This event will start on 26 May 2014 all and it

will end on 29 May 2014. G.L.D.A - Gem & Jewellery Show

- Las Vegas 2014 will take place at Mirage Events Center in

Las \/egas Nevada. This important trade event is being organical

by G.L.D.A.

G.L.D.A. - Gem &

Jewelry Show-Las Vegas 2014 is one of the most important events

related to the gems. jewellery and head sector. The event presents

the participating exhibitors with a great chance to not only

interact with prospective buyers hut also engage in high level

networking sessions and forge valuable deals and propositions.

Hundreds of dealers and buyers are expected to converge at the

event venue in order to further their business interests. The

event rides upon the success of the previous year editions and

is expected to be a major success.

|

|

| |

|

|

| |

The G.L.D.A. Shows are unique in the industry

with at least 50% of their exhibitors being direct source

loose gemstone companies and the remaining exhibitors being

the highest quality finished goods manufacturers,suppliers

mountings and equipment companies.

The 15th Annual GLDA Las Vegas Gem &

Jewelry trade show will be held in the 90,000 square foot

$120 million dollar Mirage Events Center. The Mirage Events

as Center. The Mirage Casino-Hotel is located on the in Las

Vegas across from the Convention & Expo Center.

|

|

| |

|

|

| |

Thousands ot dealers in every imaginable

gemstone. one-of-a- jewellery creations. estate jewellery.

accessories. and products for everyone from the rock-hound

to the amateur jeweller. can be found a the G.L.D.A. Show.

Deep discount and the infinite variety attract the public

to the dealers from :corner of the world: China, Indonesia.

South Africa. West Australia. Poland, Russia, Canada. the

American Southwest and more.

G.L.D.A - Gem & Jewelry Show- Las Vegas

2014 will be presenting an exhibitor profile with hundredes

of dealers, suppliers and manufacturers. The exhibitor profile

will include professionals from direct source loose gemstone

companies. manufacturers. whole- salers. suppliers of gemstones

and jewellery products. amateur jewellers. manufacturers of

jewellery and gemstone cutting and designing equipments. Some

of the gemstone varieties found in the exhibition are diamond.

pearl. ruby, sapphire, gold, antique jewellery, silver, emerald.

opal and platinum. Some other product exhibits at the event

are estate jewellery, accessories, tools used in jewellery

making, jade and opals. et|uipment used in the cutting of

gems apart from semi precious stones. branded clocks and watches.

packaging and display materials. cut and uncut gemstones and

branded costume jewellery.

|

|

| |

|

|

| |

|

|

|

The

Artist's Touch

by Amber Michelle |

|

| |

|

|

| |

"It was a classic

case of necessity breeds ingenuity,” says Ron Rizzo, creative

director, Pleve, which is both the name of the new diamond-setting

technique that he invented and the company that sells the jewellery

made using this method. Rizzo began developing the new setting

shortly after the U.S. was hit with the Great Recession.

Rizzo looked at his inventory of loose

diamonds and wanted to use what he already had because he didn’t

want to buy any new stones. “I spilled the diamonds on

to the table and I had rounds in different sizes and I had all

kinds of different shapes and I couldn't calibrate them. Then

I patted a few stones down and I thought. ‘Wouldn’t

it be great if l could use them in a random pattern‘.

Following through on his idea, and after

a lot of trial and error, Rizzo developed a high-tech, clear

ceramic in which he could set the diamonds. In terms of construction,

Pleve is similar to a mosaic. “I started by pouring the

diamonds into the ceramic, then I flattened them so that there

were no gaps between the stones. The challenge is to lay in

the stones with no gaps. They need to be girdle to girdle. The

ceramic acts as a bond,” explains Rizzo. "When you

look at the finished piece. it is like looking at a painting."

|

|

| |

|

|

| |

Made in New York

The pieces are all handmade by artisans in

New York City. "There is no metal in the setting. Pleve

breaks all the rules of building jewellery, from diamond sorting

to setting says Rizzo, "The key is mixed shapes and sizes.

We have artisans who build a piece of Pleve. We have art students

, illustrators, and a graduate gemmologist from the gemmologist

from Institute of America. There needs to be creativity. I teach

the artists how to diamonds and they look at and shape tor the

piece that they are working on."

The

process starts with an assortment of stones and a layout for

the pattern. One of the benefits of this technique is that it

doesn’t require a particular shape or size of diamond,

so a broader range of stones can be used. Rizzo notes that there

is a very mathematical formula for creating a piece of Pleve

jewellery. He likens the technique to playing with a Rubik’s

Cube — it’s challenging to the mind to put a piece

together. “We have a palette of stones and a pattern that

we use and then we build the individual piece for that pattern.

We have certain anchor stones so that we can replicate the pattern;

there is a formula with repetitive stone weights. The New York

City workshop currently is comprised of four Pleve artists and

three jewellers who work using traditional jewellery-making

techniques. The traditional jewellers will add a diamond frame

around a piece or put on ring shanks. earring backs or other

findings. |

|

| |

|

|

| |

Patent

Once Rizzo had the formula for the ceramic perfected.

he started working on the U. S. patent process.It was around

that same time that he was introduced to the Antwerp- based

diamond sightholder the Pluc/enik Group. The company is interested

in developing new ideas and bringing new brands to market.

Pluczenik Group was interested in Pleve. so they partnered

with Rizzo and invested in a worldwide patent for the technique.

Since that time. the Pluczcnik Group has been instrumental

in latinching Pleve. which was introduced at Baselworld in

2011. The collection is currently being sold by a number of

independent retailers and in select Saks Fifth Avenue stores.

“When we met Ron, Pleve was essentially

at a seed level,” comments Gadi Cohen. general manager

and chief operating officer of Pleve and Pluczenik USA. “We

immediately recognized Ron’s unique artistic approach

to setting diamonds in jewellery. We believed that if we joined

forces we could turn Pleve into the most innovative diamond

jewellery concept that the industry has seen in a long time.”

The name Pleve came about when Rizzo was doing

research to find a name for what he was doing. "We weren't

naming a technique, " he says "I was researching

names and I came across the French enameling technique ‘champleve"

l liked the sound of Pleve. I googled it and it didn’t

exist as a word. so I trademarked it. l also liked the Way

Pleve looked on paper. We created our own font for the name."

|

|

| |

|

|

| |

A

finished piece of Pleve intriguing. with a texture and patta

that is not generally seen in diamotj jewellery. Because Pleve

is a surfaé design, the pieces tend to be biggéi

“Because the pieces are bigger, it allows the design to

breathe," concludes Rizzo. "That is whenl appreciate

what Pleve is about. The technique brings out the magic and

allows the vision to come alive." |

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

| |

|

|

|

|