|

|

De-Beers'

Launches Malee Screener |

|

| |

De

Beers is now in the manufacturing stage with its melee screener

and will lease it to interested sightolders in the second

quarter before placing the device in a grading and research

facility it operates in Antwerp, making it open to the trade

more generally. The machine, officially dubbed the Automated

Melee Screening Device, or AMS , screen near-colourless or

colourless diamonds as small as 1 point and up to 0.20 carats

to determine if they are natural, De Beers said.

Unlike the screening device

for synthetic and high-pressure, high-temperature-(HPHT) treated

diamonds introduced last month by the Gemological Institute

of America that tests one stone at a time, De Beers device

can take up to 500 carats of melee at once and automatically

feeds the stones, table-down, into a measurement station.

Following testing, the diamonds

are automatically dispensed into one of five bins: - Pass:

The stone is not a synthetic or a simulant. Trials have indicated

pass rates of 95 to 99 percent for natural melee:

— Refer: A rare result, this indicates that more testing

needed;

— Refer Type ll: The sfone has a low concentration of

nitrogen and furTher testing is required, as it may be synthetic:

— Non—diamond: The stone is a simulant or synthetic;

and — Purge: This bin is for when The user needs To

empty out the machine because, for example, = placed The wrong

packet of diamonds into the device. |

|

| |

Because

the machine feeds and sorts stones automatically it

can be left unattended, and one person can operate muitipie

machines at a Time.

However, unlike the GIA,

De Beers won't be leasing its device at no cost in exchange

for data, or selling it to the general trade, at least

not righl now. De Beers said it will offer three—year

leases on the device, which was developed by De Beers

Technologies UK, To sightholders through The lnTernatlonaI

lnstitute of Diamond Grading & Research (IIDGR)

in Antwerp for $25,000 a year. De Beers declined to

say which sightholders would be leasing the machines.

Founded in 2008, the IIDGR

is part of The De Beers Group of Companies and is a

grading and research centre that offers a range of diarnond

grading services and specializes in developing verification

instruments.

|

|

|

|

|

| |

ln addition to leasing the machines to sightholders, De Beers

will install muitipie melee screening devices at the IIDGR

later this year. The cost of the screening service is yet

to be determined - and while the details are still being worked

outs, it will be available to the general trade, De Beers

said.

When asked if De Beers plans

to sell the device to the trade, a spokeswoman for the diamond

miner and marketer said the “initial plan" is to

lease the device to sightholders, which are the “current

priority at the moment.”

De Beers tested the device last year

in a pilot programme at the IIDGR. A number of the devices

also were deployed to diamond centres worldwide, to measure

the impact of differenT environmental conditions on the machine's

performance, De Beers . said.

After receiving what it describes

as “strong expressions of interest from many sightholders,"

De Beers opted to begin menufacturing the melee screener.

De Beers’ release of information

about its automated melee screener comes on the heels of the

GlA's official announcement that it had developed the DiamondCheck,

a screening device size for the detection of lab-grown as

well as HPHT- Treated diamonds as small as one point in size.

The GIA is is leasing the machines to diamond bourses around

the world at no cost in exchange for data about the stones

that get screened. Through GlA lnstruments, iT is also selling

the DidmondCheck To the wider trade for $23,900.

The bourses currently slated to receive

a DiamondCheck are in New York, Mumbai, Dubai, South Africa,

Hong Kong, Tokyo, Shanghai and Tel Aviv. Absent from this

initiall list is the bourse in Antwerp, one of the world's

main trading hubs, Though the GlA said Antwerp, along with

other diamond centres, likely will receive a DiamondCheck

laer in the first quarter. |

|

| |

|

|

|

GIA

launches DiamondCheck |

|

|

The Gemological Institute of America

has developed, and will sell to the trade, a screening device

for the detection of lab-grown as well as high-pressure, high-temperature

(HPHT) treated diamonds.

The Table-top device, called the DidmondCheck, is about the

size of a toaster oven and can be used to test diamonds from

1 point to 10 carats in size. It takes a single stone at a Time.

The diamond is inserted table down via a small black hatch that

slides open at the top of the device, which is a spectrometer

loaded with GlA sofiware developed using years of diamond data.

|

|

| |

|

|

| |

The

machine gives users one of three results about the lnserted

stone: it is a natural diamond ; it is a diamond but

should be referred to a lab for further testing because

it could be synthetic or treated; or if is non-diamond

material such as moissanite or cubic zirconia, though

the device does not specify the type of material.

GIA Senior \/ice President

of Laboratory and Research Tom Moses said that the device

is 100 percent accurate if used properly.

The GlA is leasing the

DiamondCheck to bourses worldwide at no cost, beginning

with the New York bourse and then going on to bourses

in major Trading centres worldwide including Tel aviv,

Johannesburg, Shanghai and Dubai, arnong others.

In addiTion, GIA lnstruments

will sell the DiamondCheck, which is priced at $23,900,

to interested members of the trade and any bourses that

require more than one machine. Moses said a number of

diamond dealers and “major retailers" have

inauired about buying the device, though he declined

to give any specific names. ln exchange for the devices,

The bourses, which will operate the DiamondCheck using

an internal employee trained by The GIA, will send The

machines’ data to the GIA, which will use it to

broaden ifs understanding on the type and number of

synthetics on the market.

The undisclosed mixing

of synthetics with natural, mined diamond, In melee

specifically, has been an issue in the trade for the

post several years, particularly after a parcel of hundreds

of undisclosed synthetics turned up of the lnternational

Gemological lnstitute’s facility in Antwerp in

the spring of 2012. Yet the truth is that no one entity

has any hard data about the guality of growing diamonds

is constontly evolving. |

|

Top to bottom : The GIA DiamondCheck

Mr. Tom Moses

|

|

|

| |

|

|

| |

Moses

mentioned that the GlA recently come across a diamond grown

using The CVD process that was Type la. Up until that point,

lab-grown diamonds were Type la. Up until that point, lab-grown

diamonds were Type lla. "What we get back from this is

more spectra, more experience," said GIA board member

and scientist Rodney Ewing, the Frank Stanton professor in

nuclear security at Stanford Universify.

The GlA’s DiamondCheck

device joins other synthetic detection devices already on

the market. ln the late 1990s, De Beers’ research and

development arm introduced the DiamondSure and Diamondview

machines, which are used in grading labs worldwide, including

at the GIA. The diamond miner and marketer also developed

a synthetic melee detector in recent years that can batch

test malee. De Beers is now in the process of manufacturing

the Automated Melee Screening Device. |

|

| |

|

|

|

GIA

Presentations on Rubies |

|

| |

Ruby — one of the most historically

significant and sought-after gemstones - continues to gain

widespread attention from the global gemstone and jewellery

trade. As part of the gemological Institute of America's (GIA)

mission to bring gemmological information to the public, Vincenf

Pardieu, GlA's senior manager of field gemmology in Bangkok,

will give three educational prsentations on rubies on February

8, 9 and 10 during the second annual Myanmar lnternational

Gems & Jewellery Expo.

On February 8, Pardieu will give a

Talk on “Understanding Rubies." He will discuss,

ruby deposits Throughout history — from The mountains

of Central also to the jungles of Myanmar and Thailand to

the remote bush of East Africa. Most rubies in Today’s

market originate from three different Types of deposits: classic

marble type deposits, basalt-related deposits, and amphibole~

related deposits. The study of ruby inclusions and the chemistry

from different geologic origins offen enables gemmologists

to identify whether a ruby was mined in Mydnmar, Thailand,

Mozambique or another source. |

|

| |

|

|

| |

|

|

| |

On

Februdry 9, Pardieu will give a presentation on “Rubies

from Mozombique and East Africa.” After the discovery

of The Winza ruby deposit in Tanzania in 2007, many gem buyers

moved to east Africa to find rubies. The arrival of these

buyers propelled ruby mining in Northern Mozambique and led

to rapid increase in production from the city of Montepuez.

Most rubies traded today in Thailand are from this new deposit,

and pardieu will present them and discuss their impact on

the trade.

"Rubies from Vietnam and CenTral

Asia" will be The focus of Pardieu’s Talk on February

10.

Rubies from mable-type deposits in

Myanmar are globolly recognised, and several other deposits

east and west of The Himalayan range — particularly

Vietnam, Pakistan, Afghanistan and Tajikistan— are known

for producing fine rubies. Pardieu, who has visited these

deposits. will discuss their characteristics and compare them

to Burmese rubies.

Pardieu speciallises in the origin

determination of gemstones and has visited numerous gem-producing

ares in Southeast Asia, Central Asia and East Africa and particularly

the llakaka-Sakaraha sapphire deposits of southern Madagascar

over the past decade. |

|

| |

|

|

|

India

Moves on Sybthetic Diamonds |

|

| |

|

|

| |

|

|

India's

Gem and Jewellery Export Promotion Council (GJEPC) issued

a circular to its members detailing how members can

guarontee the natural origin of diamonds that they sell

by making declarations on invoices and memos.

The guidelines form part of

a plan to deal with industry concerns over the undisclosed

mixing of synthetic diamonds with natural diamonds.

GJEPC confirmed that it has put efficient

detection methods in place; however, it noted that both

domestic and international diamond buyers have started

to request a declaration on invoices, similar to the

declaration used in rough diamond transactions, when

purchasing diamonds in lndia.

“The entire global industry

needs to be aligned on these and hence it is critical

that one organization takes the lead and responsibility,

for creating the guidelines and achieving alignment,”

GJEPC started.

|

|

|

| |

Following discussion with the World Federation of Diamond

Bourses (WFDB), The council recommended That members follow

guidelines stipulated by The WFDB as of January 6, when using

declarations, and stressed traders to monitor the guidelines

for updates and changes.

Independently, GJEPC also sought legal

counsel to understand the implications of the declarations

and repercussions that will result in the event that synthetic

diamonds are detected and a declaration is found to be false.

The council once again implored members to establish strict

internal control processes to prevent undisclosed mixing.

|

|

| |

|

|

|

Jade

Prices Rise |

|

| |

Hong

Kong jade dealers have fallen on hara times, as concerns over

a drying-up of jade from Myanmar cause prices to soar. A few

years ago, a quality piece of Burmese jade at trade fairs

in China cost about $2,700, said Li Qi, a Chinese jade trade

who own a shop in Hong Kong, and a piece of jewellery processed

from that stone could sell at 10 times the price of the raw

material.

But these days, the trade has become

far less profitable. Raw jade prices have skyrocketed so that

merchants like Li can barely afford To purchase the stones,

while cusfomers are turned off by the high prices, and demand

is falling.

“(Raw) stones that were only

worfh 10,000 yuan ($1,600) before, are now is sold of least

15,000 yuan ($2,400)," Li said. “People are definitely

buying less (jade jewellery than) last year. So, running the

business becomes a very difficult task."

Most of The world's jade supply —

as well the best— comes from the small mining town Hpakant

in the conflict-ridden Kachin region Myanmar, where Thousands

of workers bring up jade in hazardous conditions. About half

of Myanmar's yearly production of jade, which is worth about

$4.3 billion, however, Trickles over "unofficially"

to China. For 2012, The official export of Burmese jade stood

at only $34 million, which even taking into account Myanmar’s

domestic consumption, is far too low.

|

|

| |

The

government hosts several national gemstone emporiuma

each year, but jade producers prefer not to sell their

products at these emporiums as they would be subject

to high government tax rates, up to 30 percent of the

value of their sales.

And over over the past decade,

as the spending power of Chinese consumers increased,

jade prices too have risen. In response to the demand,

big jade producers are now using sophisticated technology

to speed up production, but that may not be a good thing.

"All the hills and mountains

you see produce jades and precious stones, " said

Yaw Han, a Burmese jade merchant, standing atop a mountain

in the jade mining region. " If we continue to

find jade through traditional hand-digging. I think

that we can find jade for the next generation. But,

if companies use modern technology these mountains can

be gone within 15 years". |

|

|

|

|

| |

|

|

|

We

cannot lose consumer trust in diamonds

By Philippe Mellier |

|

| |

Relationships

run deep through the diamond industry and have done ever since

the 15th century. When he first diamond betrothal ring was

given by Archduke Maximilian of Austria to Mary of Burgundy.

And today diamonds continue to represent

the ultimate relationship - the enduring emotional bonds of

marriage. However, for us, diamonds also represent our relationship

with you and the ties that bind together the people {in our

industry.

To my mind there are three fundamentally

important relationships that allowed us to achieve so much

in 2013 and that Wlll enable us to go on to further in the

year ahead. Firstly I would like to pay to the outstanding

relationship between Botswana and De Beers. We have been partners

for more than 40 years and over that time our relationship

has been prised internationally as a leading example of a

successful public-piivate partnership.

And the relocation of De Beers internationa

Sightholder sales activity last year saw the relationship

elevated to an entirely new level Botswana has grown being

a primary producer with a maturing manufacturing sector in

to one of the world' s key rough diamond trading destinations.

Not only does this bring incresed economic activity and a

regular influx of successful entrepreneurs to Gaborone but

it also sends a message to the global business community that

Botswana is so much more than the world s leading diamond

producing country.

The second relationship I would like

to talk about is that between Sightholders and De Beers Of

course. this will be the final Sight for someone who has been

central to every Sightholder relationship. and before we go

any further I would like to take this opportunity to raise

a toast to Varda Shine and say a huge thank you for thirty

years of outstanding service — not just to De Beers;

not just to the Sightholder community; and not just to the

people of Botswana and De Beers” other producing country

partners; but to the entire diamond world Varda has left an

indelible mark on the industry and it is undoubtedly a much

better place because of her influence. |

|

| |

|

|

| |

As

we all know, a lot of Varda”s time over the last two

years has been taken up with the relocation project and obviously

it has been time very well spent Southern Africa has become

the new centre of gravity for the diamond trade and the relationship

between Sightholders and De Beers has been fundamental to

this shift of course, this relationship has been at the forefront

of many of the key developments in the history of diamonds,

whether it is catalysing growth in benefieiation or growing

consumer demand for diamond jewellery in new consumer markets.

And once again, the transfer of De

Beers' international Sightholder sales operations to Botswana

has demonstrated not only our belief in Botswana. but also

the ability of this relationship to lead and deliver important

and lasting change in the diamond industry. But as the world

changes, the most successful relationships are those that

have an ability to evolve, adapt and grow.

We have therefore looked at a variety

of new ways to strengthen our relationship with Sightholders

in the next contract. We have listened to Sightholders’

views on how best to do this and will focus on simplifying

the process where possible, giving Sightholders greater flexibility

and making Sightholder status even more meaningful. We are

proud to bring the Sightholder and De Beers brand names closer

together with our new

Sightholder signature and to reinforce its importance by ensuring

that only the most financially sound and transparent businesses

qualify to use it.

All of this is focused on strengthening

the key relationships — between Botswana, De Beers and

Sightholders ~ that drive the success of diamonds And of course

this is the focus of the relocation to Botswana. The move

of De Beers’ international Sightholder sales activities

to Gaborone was integral to De Beers — and by extension

Sightholders ~ accessing long-term supply frotn the world’s

leading source of rough diamonds, while providing the nation

of Botswana with a wonderful platform to drive economic development

and diversification. |

|

| |

|

|

| |

None

of us could have achieved these era-defining successes without

the support of the other parties and our relationships can go

from strength to strength as a result of this.

The third and final relationship I would like to talk about

tonight is that between the diamond industry and its consumers.

It is this relationship that ultimately drives all of our prospects

so it is worth taking a couple of minuted of consider how it

is likely to develop in the year ahead.

Of course, any strong relationship has lts foundations in trust

and honesty. and anything that has the potential to undermine

these foundations must be taken seriously. The recent reports

of dishonest elements of the industry trading in undisclosed

synthetics represent a significant risk in 2014 and it is imperative

that we all take the necessary steps to protect our business.

However, we believe that a key

benefit of your relationship with De Beers is that we will continue

to support you with the necessary guidance and tools to help

you maintain the integrity of your business reputation. A consumer's

desire for diamonds is only true source of value in the industry.

We

must therefore lead by example, take all reasonable steps to

mitigate risks in this area and show that we are not prepared

to allow consumer trust in diamonds to ebb away as a result

of the actions of an unethical minority.

|

|

| |

And securing consumer trust in diamonds becomes even

more important when we cnnsider the positive economic

prospects in the year ahead. There are good signs coming

from the US economy with early reports of solid growth

in retail sales over 2013. and the jewellery industry

being one of the leading performers. Consumers are expressing

improved confidence in both economic and job prospects

and investors are increasingly moving away from the

safest investments and returning to stock markets. which

further supports the picture of growing economic confidence.

But question marks still hang over the consequences

of shifts in US monetary policy and its impact on the

global economy.

Looking east to China, there

are also healthy signs. The outlook for industry sales

over Chinese New Year is positive and expectations are

for a continuation of strong economic growth, at around

the same level as that seen in 2013. The Chinese government's

policy of refocusing the economy so that growth is generated

by consumer spending rather than state investment should

be of benefit to the diamond industry over time. but

we

will need to keep a watch on how this transformation

is managed.

Meanwhile. India, the other

engine of growth for consumer sales of diamond jewellery

in recent years. experienced a more challenging domestic

market in 2013. Although there are some ongoing concerns

about inflation and currency volatility. improvements

in the agricultural sector could trigger an upswing

in domestic demand and the economy can be expected to

pick up further after the elections in May. There is

also better news on economic prospects in Europe and

Japan, with the Eurozone starting to see a rise in industrial

production and Japan's economy bcnelitting from its

monetary and fiscal stimulus programme. In short, things

are looking up.

|

|

|

|

|

| |

So, in 2014 let us build on the firm foundations we have established,

continue to invest in the outstanding relationships that have

brought us so far and ensure we keep on working together for

our mutual benefit. With Sightholders at the centre of the

De Beers business and Botswana at the centre of the diamond

world. we approach a year alive with possibilities. Then we

continue to nurture the relationships on which our success

is based then we will also make sure that diamonds remain

the symbol at the centre of the consuniei"s universe.

De Beers Group chief executive Philippe

Mellier recently delivered the above speech at a dinner in

Gaborone, addressing senior representatives from the Republic

of Botswana, De Beers Sightholders and leading figures of

the Gaborone business community.

|

|

| |

|

|

|

Ruby

& Sapphire : A Collector's Guide |

|

| |

|

|

| |

The Gem and Jewelry lnstitute of Thailand is to be congratulated

for publishing this most excellent book. Produced by The leadership

Team of The lnstitute, The book is an acknowledgement of their

dedication and expertise this volume embodies Three Things seldom

seen Together in a book today: Stunning pictures; a most readable

Text; and important information.

Of coffee-Table format, This large (24x28 cm) volume is decidedly

not a coffee-Table book in the usual sense of the term it is

a book to be read and re-read, savoured, refered to and treasured.

For enthusiasts of ruby. sapphire, gemmology or jevvels, This

book is a must.

The Book is just what the title says: a guide for collector.

It is neither an exhaustive technical treatise, nor a gemmology

textbook. The book will assist collectors of ruby, sapphire

and gemstones in coming to a greater understanding and appreciation

of their specialty.

|

|

| |

|

|

| |

Author Richard W Hughes is a prefessional gemmologist of long

standing, and based in Bangkok. He is an accomplished writer

with an engaging literary style. He has Travelled to all The

producing ruby and sapphire fields worldwide. His unique portfolio

of expirience and ability has resulted in a volume which is

bound to become a classic.

The sections on gemmology and gemstone

appreciation are sufficient to enhance a collector’s

understanding of the science that lies behind all beautiful

gemstones. Collectors should find find useful the section

dealing with gemmological laboratory reports.

Worthy of special note is the large

section (228 pages) on the countries and gemfields producing

ruby and sapphire. A concise but comprehensive overview of

each production district is accompanied by remarkable photographs

— of gems, mines, locales and people, which together

impact a very real sense of travel and adventure in remote

and inaccessible pieces.

The sections devoted to Thailand

describes the country's progress from cottage industry to

today's status as a global centre for production and trading

of ruby and sapphire, all within 50 years. |

|

| |

The section on the collecting of books on ruby and sapphire

is truty a gem in its own right. The author reveals

a passion for book collecting that comes through on

every page. The bibilographies are volumnous and invaluable.

Throughout ruby and sapphire:

A Collector's Guide, " The pictures are a delight,

may being the author's own photos. Most of the gemstone

photographs were taken by two renowned Bangkok gemstone

photographs were taken by two renowned Bangkok gemstone

photographers, Ms Wimon Manorotkul and Ms E Billie Hughes,

All pictures in the book are attributed; the owners

of the gemstones photographed are acknowledged.

Above all, This volume gives

or insight t the philosophy and psychology behind The

collecting of ruby and sapphire. Beauty, rariy,wonder

- for whatever brings collector under the spell of ruby

and sapphirre, This volume is indeed an informaiive

and useful guide. "Ruby & Sapphire: A Collector's

Guide" is worthy of a place on The bookshelf of

every gemstone enthusiast. |

|

|

|

|

| |

|

|

| |

|

|

|

Christie's

Online-only Jewellery Sale |

|

| |

Christie's is holding Statement jewels. The online only sale

of jewellery pieces. Comprising over 80 lots with price points

accessible to a wide range of collectors, this sale offers

an eclectic array of coloured stones, diamonds, jadeites,

cultured pearls, watches and more. The sale will open for

bidding on Tuesday, February 25th and run through to Thrusday,

March 6th. It is accessible Via www.christies.com/statementjewels. |

|

| |

|

|

| |

In 2013, Christie's achieved the highest

annual result ever for jewellery in the auction house with

US$678.3 million. Further to this milestone, Christie's continues

to develop innovative sale channels, including the statement

jewels online-only sale, providing jewellery lovers with an

exclusive opportunity to acquire unique pieces from private

collectors.

Highlights include a set of ruby and diamond

jewellery, by Van Cleef & Arpels, a set of emerald and

diamond jewellery by Chaumet, and a set of ruby and diamond

jewellery, by Van Cleef & Arpels. |

|

| |

|

|

| |

|

|

|

Timeless

and Trendsetting Pearls |

|

| |

For Thousands of years The Persian Gulf

was The hunting ground for pearl divers, armed with nothing

more Than a knife and nose clip. Dive after dive, These men

spent months in the salty water, risking life, limb and their

sight on the hunt for the most perfect of natural pearls.

Pearl farming Today is a very different art, with cultured

pearls and freshwater goods dominating The gem's use in jewellery

design, but the story of pearls — from those ancient

days in the environs of Qatar through to adorning starlets

on the red carpet today — still capTures our imagination.

The recent exhibition at the \/&A Museum

in London bought together thousands of years of pearl history,

with designs from Cartier, Mikiimoto and Hemmerle and pieces

worn by King Charles l, Marilyn Monroe and Elizabeth Taylor.

The exhibition, a joint partnership between

the \/&A and The QaTar Museums Authority, was overseen

by co-curators Beatriz Chadour-Sampson and Hubert Bari, with

Chadour-Sampson, a jewellery historian. adding jewellery from

about 40 private lenders and companies To The exhibition,

which had previously appeared in both Qatar and Japan.

"From curating the exhibition I have

realised pearls are a global phenonon, "says Chadour

Sampson. "If you have gemstones They are usually sourced

at a certain time owing to a lift in demand but pearls have

remained fashionable over years and across cultures."

Chadour-Sampson point our that pearls are

a gem worn universally in The east and West. Whether for cockttails

in London or to work in Osaka ; They transcend cultures as

diamonds have, and surpass the popularity of many coloured

stones.

The history of pearls in the Middle East

is also evolving and, where pearls were once a trade, exported

by gem dealers for use all over the world, they have become

a status symbol, with many ancient pieces of natural pearl

jewellery being revamped for a modernday Middle Eastern customer

willing to pay the heftier price tag commanded by natural

pearls. |

|

| |

|

|

| |

1.Lizabeth Taylor was partial to

a pearls

2.'Frozen' by Germany-based designer Sam Thi Duang uses tine

freshwater seed pearls

3. Precious : An Akoya pearl necklace, previously owned by Marilyn

Manroe, which is one of the items in the items in the V &

A exhibition |

|

| |

While

natural pearls are rarely fished today, They regularly hit

the headlines when sold at auction. As Chadour-Sampson notes,

natural pearls that would have cost tens of Thousdnds of dollars

at auction 20 years ago are today fetching millions. They

s’starred in several fine jewellery auctions in 2013,

including Sotheby's Geneva auclion of Gina. Lollobrigida's

jewels, in which a pair of natural pearl earrings sold for

CHF2.29 million. AT a Christie's Geneva sale in May lost year,

a single strand natural pearl necklace went under the hammer

for US$8.45 million, setting a world record for This slyle

of neckldce sold at auction.

“The symbolism has chdnged for pearls,”

states Chadour-Sampson, referring to 1930s Cartier neckldce

selected for the V&A exhibition boasting five strands

of graduated, natural pearls. Many of those glancing upon

it today would be hard pressed to comprehend just how many

dives the necklace would have Taken to make. “It Tells

you a story about how long it takes to put together, but we're

spolit Today as we have access to cultured pearls.”

she adds.

The cultured pearl, championed by Kokichi

Mikimoto who invented cultured pearl farming on an industrial

scale, has become the norm for jewellers Today. “Mikimoto's

dream that any womon could adorn her neck with pearls has

become very true," explains Chadour-Sampson. “But

it has also gone way beyond him now as Chinese mass production

of pearls by the tonne means that everyone can afford a pearl

necklace.”

The rise of fine cultured pearls has also

answered modern-day consumers’ desire for absolute perfection

in their jewellery. The most prized are larger South Sea or

lustrous Tahitian pearls that have a strong, uniform colour,

in hues that imitate the colour of the mollusc shell in which

they grew. “The rarities of today are The South Sea

pearls,” says Chadour-Sampson. “The most expensive

are those in natural, untreated colours; in The exhibition

we showcased rare examples in shades of pink, gold, black,

pistochio green, aubergine, and lavender.”

Despite the boom in cultured pearls,demand

for imitation pearls has also grown. While not a new phenomenon

— imittation pearls have been in production for hundreds

of years, made using various materials and means — They

have certainly widened the scope of customer now buying and

wearing pearls. “l Think we've come a long way from

the stigma of grandma's necklace, ” says Chadour Sampson

in reference to imitation pearl jewellery . “Certainly

pearls are attracting wearers, and what started in the 20th

century with Coco Chanel wearing imitation pearls has become

democratised in 21st century. Today pearls have a different

story to tell and you can wear them with anything." |

|

| |

|

|

| |

4.Channel-Pearls

5.Sotheby's recently sold the pieces in the Miss Lollobridgida

collection for $4.9 million. Among the items sold were a pair

of fabulous diamond and natural pearl earrings. A spokeman for

the auction house said that eight bidderes veid for the earrings.

They fetched $2.3 million from the highest bidder, setting a

new auction record for an item of that nature

6.Magnificent : A 1930s Cartier necklace made from Gulf pearls

and finished with diamonds and platinum clasps

7.Mikimoto pearls necklace |

|

| |

Among Today's boundary-pushing

pearl wearers are the likes of pop stars Lady Gaga and Rihanna.,

and the actress Sarah Jessica Parker , both as herself and as

the character Carrie Bradshow, whom she portrayed in The series

Sex & The City for six yeors. Each is known to layer up

her pearls with other jewellery“ or wear them in chunky

cuff or choker form.

Alexander McQueen’s

AW13 runway paid homage To The Elizabethans wilh lashings of

freshwater pearls that adorned intricate jackets and even face

masks. “l would more and more as an interestlng adornment;

They are being used in on clothes, on bags and on boots in lavish

quantities," states Chrissie Douglas, The founder of brand

Coleman Douglas. “Pearls can be fun and serious at the

same time ”

Their pop-culture

positioning in to the minds of younger consumers, up The various

style references, whether subtle or outlandish, and translating

them “Rihanna is promoting Chanel someone wearing the

same look, the whole Chanetto do (like Rihanna), says Chadour-Sampson. |

|

| |

|

|

| |

8.A model wears freshwater pearls

in the Alexander McQueen AW13 runway

9.Rihanna

10. British pearl brand Coleman Douglas |

|

| |

|

|

|

Opportunity

for Thai Gem Industry in Ingeria |

|

| |

|

|

| |

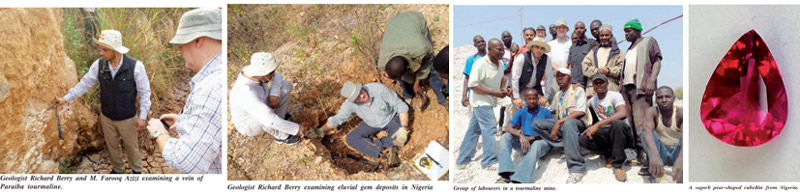

Before

the economic slowdown of the western world in the last decade,

business was booming for precious stone dealers across the

world. This boom resonated in Thailand's coloured gemstone

market and consequently benefited the miners in Africa, especially

Nigeria. Surprisungly, even after the economic slowdown in

western markets 7 years ago, the coloured gemstone mining

sector grew exponentially . This was due to the ever higher

demand for gemstones in the eastern markets, especially China.

China has not only sustained and buoyed

the gemstone market for the past 7 years, it is the sole reason

behind the boost in gemstone mining. Nigeria, a mineral-rich

country, has enjoyed this boost and has continued to be a

top supplier of rough coloured stones. Due to this recent

surge in Chinese demand, Nigeria has opened new opportunities

for miners and foreign investors. |

|

| |

|

|

| |

Most

gemstones from Nigeria are highly prefered by the market due

to their attractive colours, high quality and crystallization;

for example, Rubellite, Spessartite Garnet, Kunzite, Tourmaline,

etc.

Previously, most African mine

production, including from Nigeria, headed straight towards

the markets in Thailand, mostly Bangkok and Chanthaburi. That

trend has gradually declined in the past decade due to many

obvious barriers. This reduction of business and raw material

may well be due the country's political uncertainties, lack

of business incentives, slow and complex customs procedures,

and weak or non-existent trade agreements with mineral-rich

countries like Nigeria. |

|

| |

|

|

| |

In

other words, Thailand has not taken the necessary steps to

continue its lead in being a top coloured gemstone and jewellery

hub. On the contrary, it has played catch-up in the race against

other emeraging and highly competitive markets. Unlike Thailand,

these other gemstones hubs have given strong incentives to

pull the business towards them. These incentives range from

government funed cash injections, to open customs import taxes

and VATS. As an example, most African gemstone miners, including

those of Nigeria, head straight to Hong Kong, a strong and

competitive gemstone hub, because of its highly simple and

uncomplicated customs procedures. |

|

| |

|

|

| |

Without

a doubt, this process of gemstone mining in Nigeria will increase

far into the future and the Chinese demand for finished gemstones

will increase as their market matures even further. Thailand

can start off by strengthening its trade agreements with Nigeria

and possibly invest in the Nigerian gem mining sector. Furthermore,

Thailand can play an important role between the mine and the

end markets by positively engaging its skilled labour, manufacturing

installation, and the required materials. This process of rough-to-finished

product can promise more stable jobs and opportunities for Thai

workers and businessmen. It is to be hoped that the Thai government

will direct an urgent focus towards this industry, and that

Thailand this industry, and that Thailand can continue to be

an influential hub for gemstones and jewellery. |

|

| |

|

|

|

Breathtaking

Jewels by JAR |

|

| |

|

|

| |

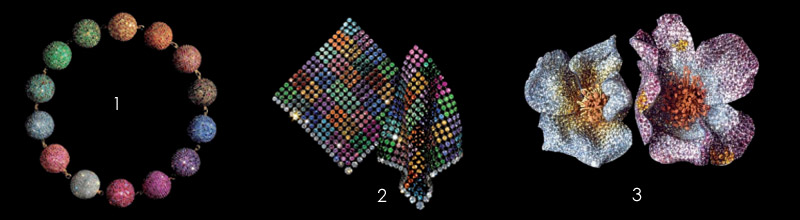

1. Colorred Balls

necklace, 1999, with rubies, sapphires, emeralds, amethysts,

spinels, garnets, opals, tourmaline, aquamarines, citrine, diamond,

silver and gold. Photograph by Jozsef Tari. Courtasy of JAR,

Paris.

2. Multicolorred Handkerchief earrings, 2011 with sapphires,

demantoid and other garnets, zircons, tourmalines, emeralds,

rubies, fire opals,spinels, beryls, diamond, platinum, silver

and gold. Photograph by Jozsef Tari. Courtasy of JAR, Paris

3.Jewel by JAR |

|

| |

|

|

| |

4. Butterfly brooch,

1994, with sapphire, fire opals, rubies, amethyst, diamonds,

silver and gold. Photograph by Katharina Faerber. Courtesy of

JAR Paris

5. Poppy Brooch, 1982, with tourmaline, diamond and gold. Photograph

by Katharina Faerber. Courtesy of JAR Paris

6. Raspberry brooch of rubies, diamonds, bronze, silver, gold

and platinum by JAR, 2011. . Photograph by Jozsef Tari. Courtesy

of JAR Paris |

|

| |

No retrospective of any contemporary artist

of gems has ever been featured in the Metropolian Museum displays

more than 400 works by renowned jewellery designer Joel A.

Rosenthal, who are better known by his initials JAR. The exhibition

is the first retrospective in the United States of his work.

"We are not afraid of any materials,

" said Rosenthal. The designer takes unique approach.

He uses metals as strong as platinum and as lightweight as

aluminuim as bases. Rosenthal also reintroduced the use of

silver in fine jewellery making and blackened the metal to

enhance the colour of the stones and the shine of the diamonds.

His two significant design themes are flowers and butterflies

often in the form of brooches.

|

|

| |

|

|

| |

Rosenthal

grew up in Bronx, New York. He attended Harvard University

and moved to Paris shortly after his graduation in 1966.

It was in Paris that Rosenthal met Pierre Jeannet, the

other half of the JAR story. The two first opened a

needlepoint shop. For Rosenthal needlepoint meant painting,

mainly flowers, on a white canvas and playing with mainly

flowers, on a white canvas and playing with the palette

of the colours of the woods. In 1976, Rosenthal moved

back to New York to work at Bulgari but returned to

Paris and decided to open his own jewellery business.

JAR was opened in 1978 first on the Place Vendome but

then relocated to a larger space next door to better

cater to their growning client base. They also expanded

the team to include the few exceptional craftsmen still

specializing in this field.

In conjunction with the exhibition.

JAR has designed a unique collection of earrings and

watches for the Museum.

|

|

|

| 7. Cameo and Rose

Petal brooch, 2011, with rubies, diamonds, silver and

gold. Photograph by Jozsef Tari. Courtesy of JAR Paris |

|

|

| |

|

|

| |

|

|

|

Alorosa

Creating a Brand |

|

| |

Although Russia's largest diamond miner

Alrosa well known domestically and in the rough industry,

its name means to most consumers buying at retail. A new

worldwide marketing and branding cambaign, which includes

selling diamonds polished mine miner s manufacturing subsidiary

through top international auction houses such as Sotheby

s designed To change that.

Reaching Out

"While De Beers is known worldwide

Alroso doesn't enioy such popularity. We hope to make the

company well known through Sotheby's diverse clientele the

private buyers who not port of the trade, said Alexandar

Malinin, director general of Brillanty Alosa, the cutting

and polishing subsidary the miner established in 2000.

Alrosa signed a memorandum of cooperation

with Sotheby‘s in May 2013 for its diamonds to be

sold through the auction house. So far, The company has

token part in one auction in February, at which it sold

two diamonds, and a second one in September, at which it

sold three pink diamonds and one brown diamond. It is plannlng

to sell a 47—carat round diamond at auction either

by the end of 2013 or early in 2014.

“There was spirited bidding for

the items that were consigned by Alrosa. People appreciated

not only the vibrant colours of the diamonds presented but

also the exceptional cutting quality,” sold Gary Schuler,director

of Sotheby’s jewellery department.

|

|

| |

|

|

| |

1. This stone

was produced at Alrosa's mines, one of the world's major sources

of high quality diamonds located in the Yakutia region of

Russia. The pear-shaped Fancy Dark Brown Diamond weighting

40..45 carats and graced with small round near-colorless diamonds,

was set in an 18-karat gold ring

2. Alrosa and Sotheby's signed a letter of Intent

3. Alrosa brown diamond sold at Sotheby's

4.Alrosa put up for Important Jewels Sale was the Fancy Coloured

Diamond and Diamond Pendant Necklace (platinum)

|

|

| |

Two Programmes

In the first stage, Alroso has Iaunched two

programmes: one for large diamonds and the other for coloured

diamonds — each designed not only to increase profits,

but also to market and brand the company's diamonds.

Athough Alrosa is the second-largest diamond

miner in the world and has just completed its initiai public

offering. (IPO), The company has solid reasons for wanting more

name recognition “The more people know about Russian diamonds,

The more they will want to buy them, and this will mean more

sales for Alrosa rough,” said Mallinin, nothing that the

Russian cut,while it has a certain reputation in the industry

for quality, needs wider exposure with the general public.

lt is not a new idea. Kristall Smolensk,

the country’s largesl diamond manufactuer,has been working

separately on promoting the Russian cut for a long time Milinin

doesn’t exclude cooperation with other Russian manufacturers

on branding initiatives in the future, although there haven't

t been any negotiotions among them to This point. |

|

| |

|

|

| |

The

other reason forcreating a promotional programme is that the

diamond market in general has long needed a marketing initlative.

“There hasn't been anything similar to De Beers ‘diamonds

are forever’ campaign for a long while,” said

Malinin. “In addition, The diamond market is facing

threats, first and foremost from synthetic diamonds.”

Tracking Prices

Brillianty Alrosa was first established

to serve as a price— tracking vehicle on the world market

for Alrosa diamonds. The manufacturing subsidiary buys around

5 percent of Alrosa's rough, and generated sales of $160.5

million in 2012. The company sells its large size diamonds

directly to clients or through approximately five annual auctions

held in Alrosa's offices in New York, Antwerp, Hong Kong and

Ramait Gan.

Even Though The company is the miner's subsidiary,

Malinin said it buys the same lots and on the same terms as

other Russian manufacturers. But unlike other Russian companies,

which sell off the rough that is not profitable for them to

polish — usually rough smaller than .30 carats ~ Brillianty

Alrosa polishes all The rough it buys to get a complete reading

of market prices for all sizes.

The Message

The promotional and branding campaigns the

manufacturer was assigned to develop are potentially very

profitable. “The record prices have been on exclusive

stones, either big stones in D or F colour or fancy colours,”

said Malinin. “Exclusive stones are less subject to

fIuctuations of the financial markets and their prices should

continue to rise.” He added that selling them through

auctions such as Sotheby’s provides good publicity for

the companyln, In addition to achieving the highest prices.

Since The launch of the marketing effort,

the company has polished six rough stones over 50 carats and

five other large diamonds are being polished of the moment.

The stones are carefully selected by a group of the company’s

top employees. The cutting and polishing work on one stone

takes over two months with the best and the most experienced

of Brillianty Alrosas 150 polishers assigned to the task.

Malinin said that the quality of the cut is what makes a stone

unique. Sergey Lutsishin, The companys head engineer, proudly

adds that the perfect polishing could not be achieved without

a special technique the company uses to restore the perfecfly

srnooth surface of its polishing disks using machines designed

specifically for the company. Alrosa also has a 52~ carat

pear that will be offered for sale, as well as a number of

diamonds larger than 20 carats.

The skill of the company's cutters was established

by a recent ruling by a special expert the of the country's

metals and gems that one of its stones, a round diamond to

be sold at Sotheby's, was prohibited from being sold country

because it was “unique” by Russion According to

Russion , large rough and stones have to be by the subcommittee

to determine if they are “unique” or purpose of

the legislation especially significant diamond within the

country. The Irony in this case was that the rough stone over

100 carats had not been deemed unique by the been the polished

one out of it was ruled unique, testimony to the skill of

the cutter.

Stones considered unique offered first to

The Russian Finance and if it declines the Republic of Yakutia,

diamonds are mined. In case, it was only after those two parties

confirmed they willing to buy the stone company asked for

the permission to sell it abroad., it took half a year to

get the necessory paperwork signed by The prime minister before

the diamond could be scheduled for auction by SoTheby's.

Fancy Colours

Coloured stones are another product of which

the compony is proud. The rough for these stones comes from

the alluvial deposits of Almazy Ansbara—which contain

a large percentage of colour diamonds, mostly fancy yellow

— and Severalmaz, located in the northwest section of

the country.

“Coloured stones are commercially

profitable, which meansthat the difference between the cost

of polished and the cost of rough is very large," said

Malinin. “When a stone is certified, that certification

gives it approximate price, but when one buys rough, it is

not always clear what the outcome will be.” The three

pink diamonds— .30.50 and 1.02 carats -that were sold

at Sotheby's in September for $230,000 come from The rough

of Seyerqlmaz.The mine has yet to reach its full production

capacity,which is expected in late 2013. Malinin recalls that

the rough out of which The Three pinks were created was nothing

special beginning, but when the rough cutting was done, unique

were uncovered.

During 2013, Brillianty Alrosa bought approximately

60 colour stones weighing over 100 carats in total from Seyerdimqz,

which in, miner had collected over several years. Malinin

said that the company is currently negotiating with big jewellery

firms to sell them a steady supply of coloured stones mostly

small ones.

For the long term, the hope is that new

marketing efforts wil result in a well-known brand name and

brand reputation for Russian diamonds. Malinin believe the

compony has the company has for creating a brand would be

widely recognized and approxing to the public. First of all,

Russian diamonds are unique in their quality, secondly, They

are not conflict diamonds and third they are mined in an ecologically

clean environment and cut to triple excellent quality standards

“De Beers has its Forevermark, we need to create something

of our own ” concludes Malinin.

|

|

| |

|

|

| |

|

|

|

|